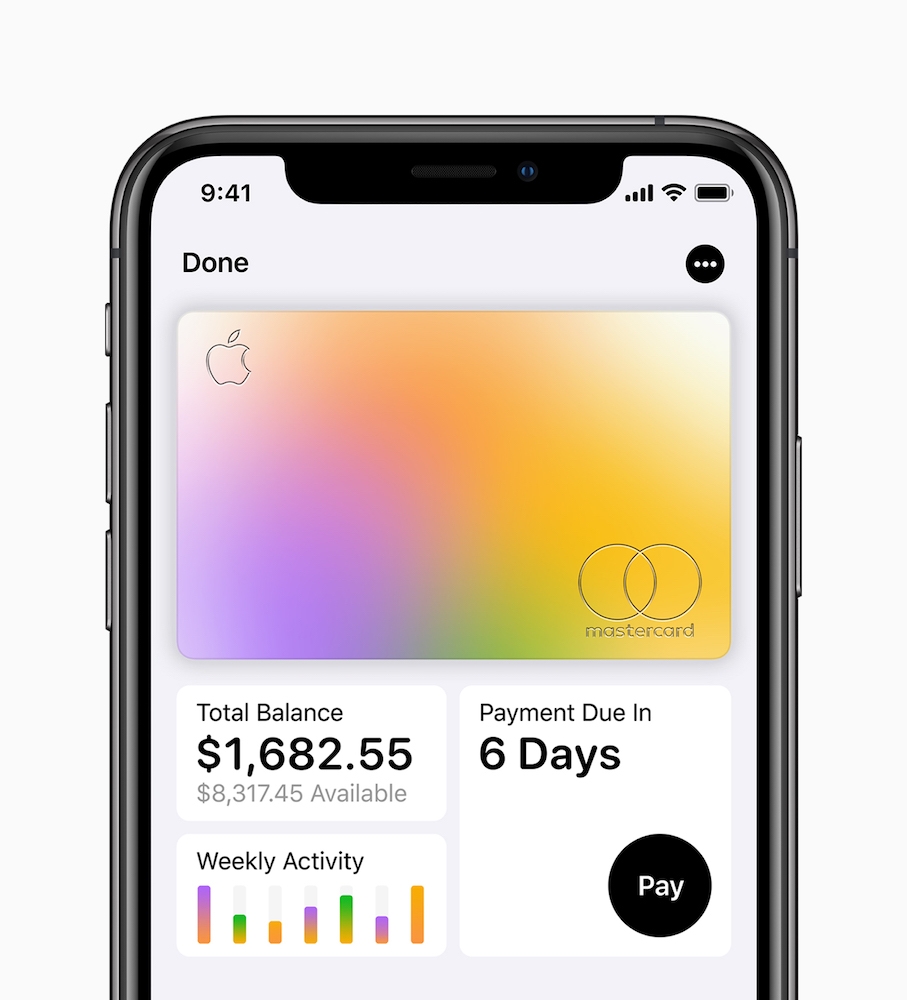

New Apple promo hints at need to innovate Apple Card (again)

The Apple Card app tries to put you in control…

Apple Card users in the U.S. are beginning to receive special offers from Apple and partners via the Wallet app, including free access to services and more.

What’s on offer

Apple is currently offering Apple Card users three months free access to News+ in addition to unlimited coffee in an offer sponsored by the MyPanera+ chain.

This builds on existing offers from the company in which it provides deals from other retailers and service providers. Logically it’s a similar approach in which third party companies can make use of the offers system to try to reach Apple’s customers.

Why it matters

Apple Card very quickly grew success, but Apple now faces similar challenges to everyone else in the challenger bank/financial services space as agile competitors build up their own offerings in response. Cashback deals, travel insurance, crypto and stock trade support are becoming regular offers among some challenger banks, particularly the excellent Revolut service (join Revolut with this link and I get paid) which continues to diversify its offers.

Apple, of course, moves slowly as it must, given its market clout it can’t be seen to swamp the market with new business expansions, and relies fairly strongly on its customer loyalty and wealthier demographics to support its Goldman Sachs-backed credit card system.

At the same time, the company can’t remain too static, so the notion of partnering up with third parties to deliver offers and inducements to its Apple Card community is a perfectly good step.

Apple Card, metal, and you don’t need to carry it

But will it be enough?

We know Apple is looking to maintain momentum with Apple Card, just as it does with any other product. That’s why it introduced Apple Card family sharing earlier this year and also lets users combine credit limits from other accounts. The company hasn’t yet internationalized the service, and it’s arguable that by the time it does Apple Card will already have fallen steps behind competition in the disambiguation of financial services space. This was the card, after all, that achieved global coverage as representing the tech industry’s vision of the future of financial services.

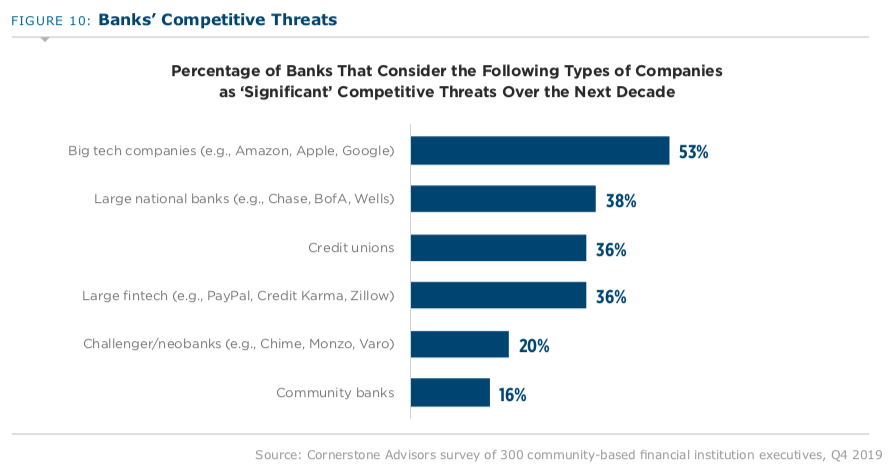

The thing is, while slow, incumbents in the space are no longer standing still and seem increasingly willing to experiment with more agile financial services. Big banks now offer strategic cashback deals and access to additional experiences from within their apps, are more willing to engage in partnerships with challenger upstarts, and seem more willing to engage in arms-length experimentation in terms of exploring new financial services, usually in partnership with medium-scale firms in emerging markets.

How Banks see new financial challenges

What’s in the way?

In other words, like any Apple product Apple will need to identify strategies through which to freshen up its Apple Card offer, even as smaller and more nimbler competitors seek advantage. The biggest low hanging fruit still seems to be international expansion, but the slow-paced rollout suggests this may not be the primary strategy Apple seeks right now – Apple Pay Cash, for example, is a meaningless pester message for most Apple customers.

Up next? It’s hard to tell, really, but it does seem rather open to question to consider just how long tight OS/card integration, 3% daily cashback and strategic sponsors and marketing offers will remain as alluring a prospect and to what extent Apple can continue to inject fresh energy into its credit card.

From March 2020, here are some Apple Card statistics you may not have come across before:

- A third of Apple Card users have an income in excess of $100,000.

- Another third have incomes under $50,000.

- 56% of Apple Card users have college degrees.

- 6/10 customers use the Apple Card as their primary card.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.