Social media just keeps talking about Apple Pay Later

Apple has indisputably built the world’s most talked about mobile payments service ecosystem with Apple Pay, and this is giving the company a good platform from which to enter the Buy Now Pay Later (BNPL) space, according to GlobalData.

GlobalData’s latest survey looks at social media share of voice across both Twitter and Reddit in terms of brands mentioned in conversations concerning BNPL services. Apple and Apple Pay leads the conversation across the last twelve months, making it the top mentioned company with 19% share of total social media voice.

Mind share as a profit centre

Apple isn’t completely dominant as it’s a fairly close field – but it must be remembered that even though the service was announced in June 2022, it didn’t actually go live until March 2023 and is available in the US only. This implies room to expand mind share in the next twelve months, particularly if Apple extends the service into other nations.

Others in the field scored thusly:

Afterpay Touch Group Ltd with 18% share of voice, Klarna Bank AB (17%), PayPal Holdings Inc (16%), Affirm Holdings Inc (10%), Mastercard Inc (7%), Sezzle Inc (5%), Mondu (3%), Openpay Pty Ltd (3%), and Camden Town Technologies Pvt Ltd (2%).

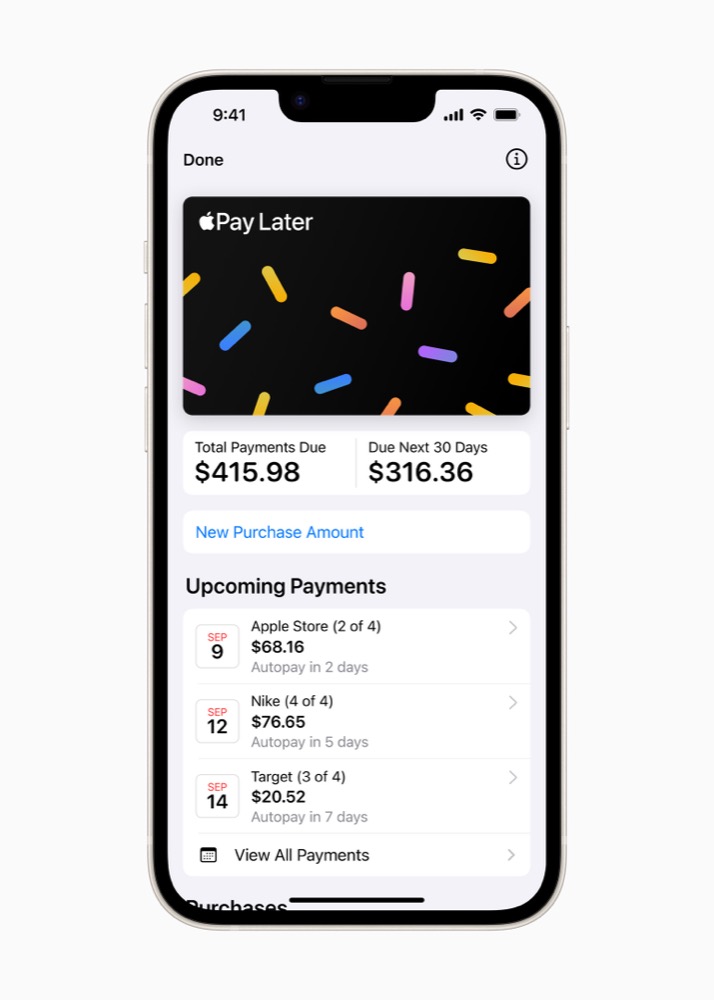

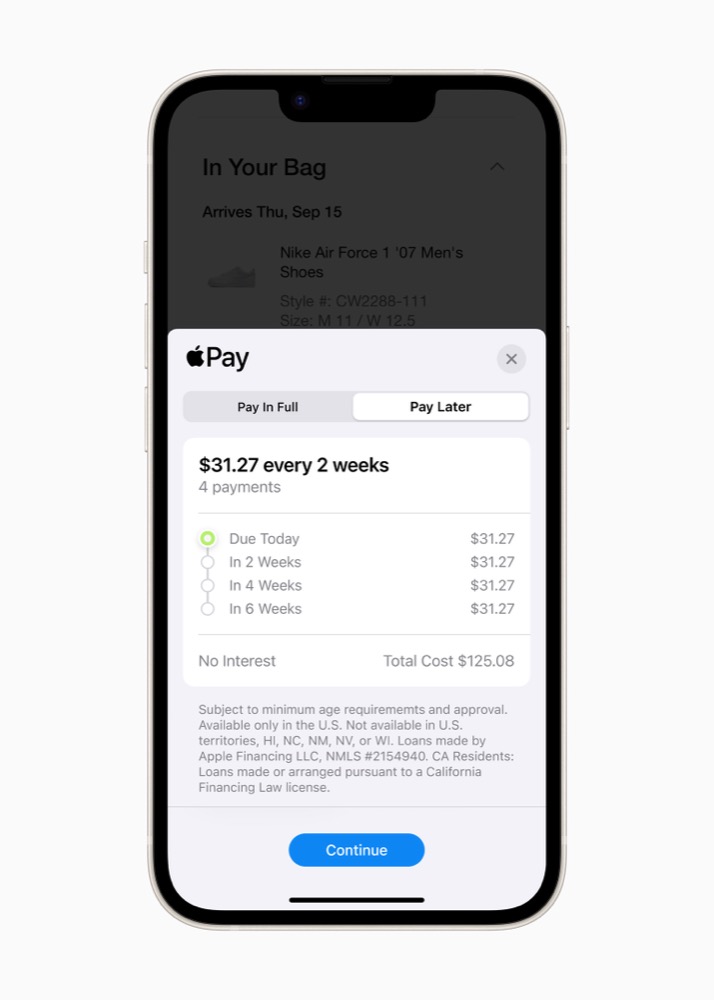

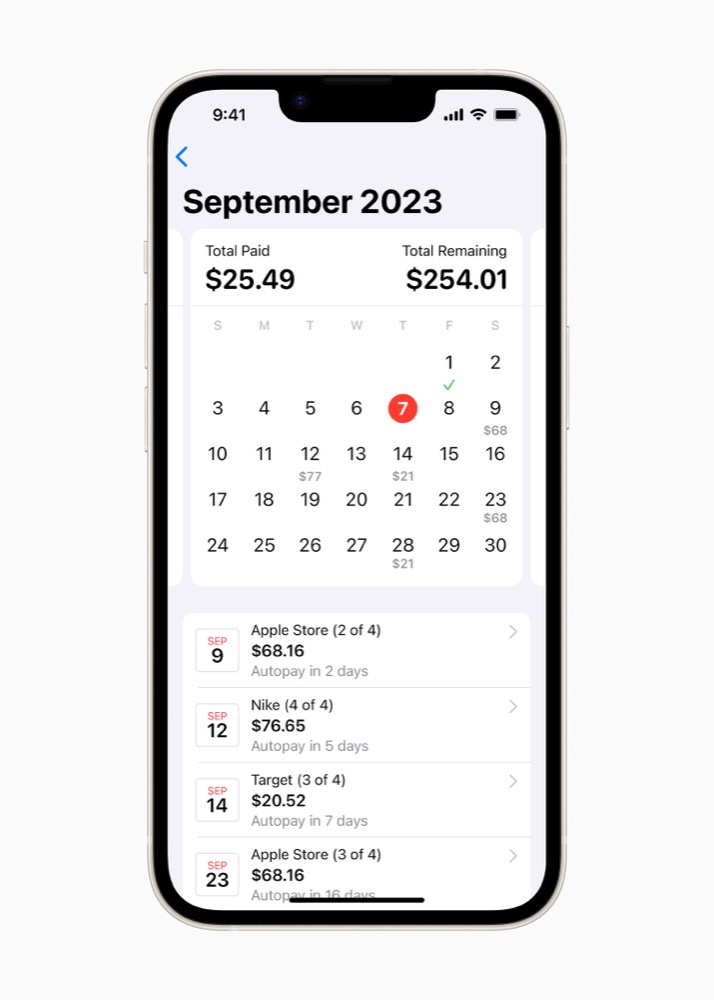

Apple Pay Later looks like this at checkout

PayPal has more competition

What’s possibly significant is that PayPal experienced a 70% drop in conversations concerning its own BNPL services. Apple Pay dominated conversations around BNPL during the last one year and saw more than 130% growth over the previous 12 months, following a spike in coverage in June 2022.

Shreyasee Majumder, Social Media Analyst at GlobalData, comments:

“Influencer sentiment around BNPL saw 22% decline among social media discussions during the same period over the previous 12 months. Influencers opine that consumers were earlier inclined towards BNPL when rates of interest were at low levels and also because of its simplicity and ease of access to credit.

“However, the combined effect of rising inflation and interest rates has a detrimental effect on BNPL providers due to reduced consumer spending and rising repayment rates.”

Now, social media chatter is never really enough to make decisions on a granular basis, but certainly in terms of trend it seems to show the opportunity Apple enjoys when it comes to introducing additional financial services via its Apple Pay arm.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.