Statistical flaw means Mac sales fall 23%, it doesn’t matter

Gartner, IDC, and Canalys PC sales estimates are in, and they show that Mac sales fell by around a quarter year-on-year, but that’s not quite as big a deal as it sounds, Apple had been expecting it anyway.

Down but not out

The three analysts introduce quarterly PC market share reports four times a year. In recent years these have pretty much seen Apple on track for market share growth, even as sales declined slightly. That’s because while Apple’s sales fell, those from competitors fell more.

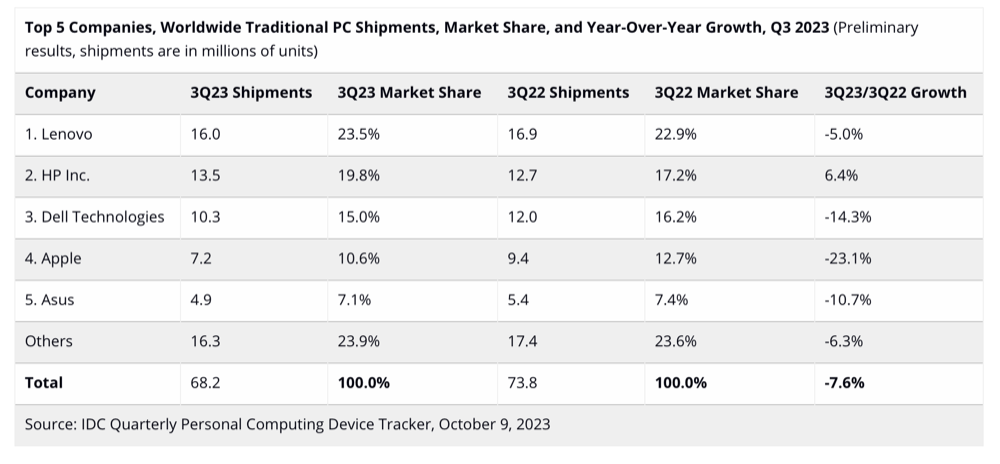

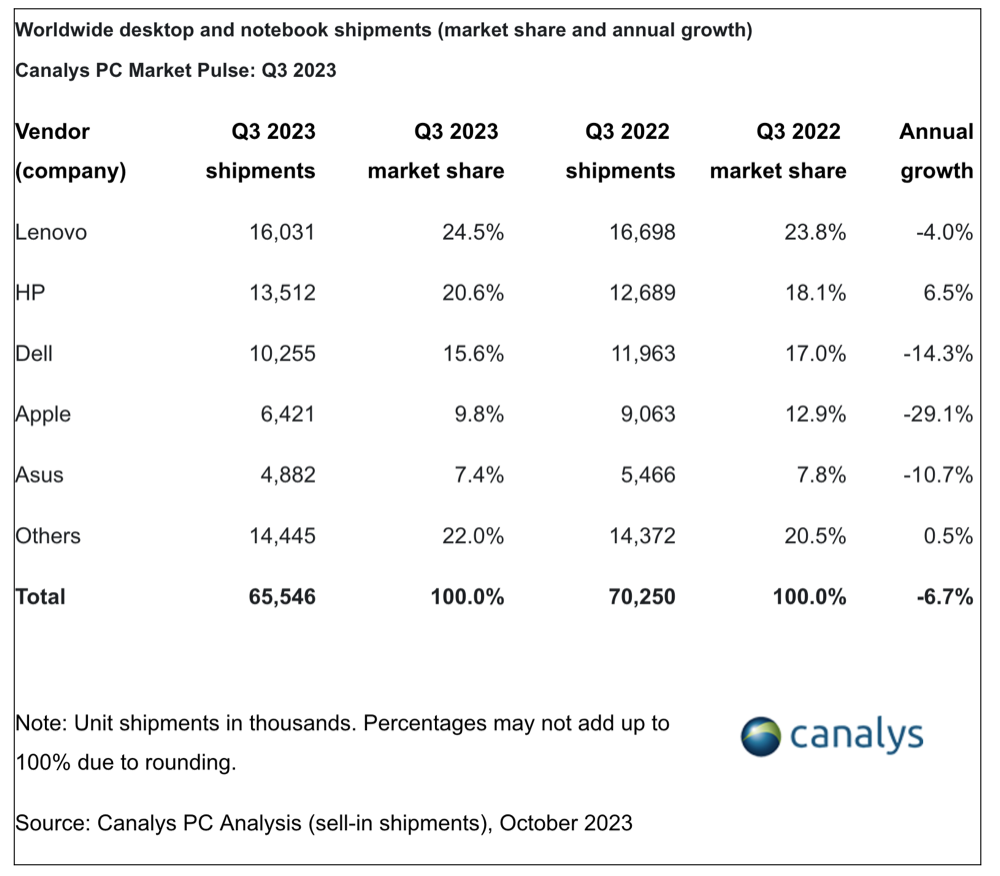

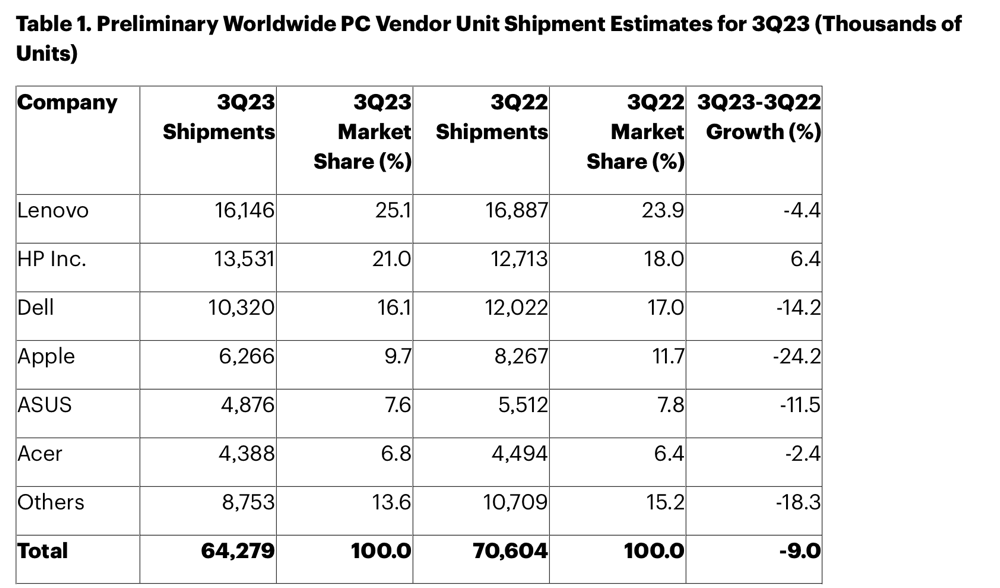

Yet, in the just gone third quarter 2023, Apple’s sales fell year-on-year. The extent of that decline differs depending on which analyst you trust. Canalys sees a 29.1% YoY drop, while Gartner pegs this decline as being around 24.2% and IDC estimates a 23.1% decline. I’ve reproduced charts from all three analysts for your personal review below.

What all the analysts agree on is that Apple’s decline was kind of a statistical anomaly.

The COVID shutdown SNAFU

Think back to the same period last year and the company was recovering from a COVID-related halt in production.

That halt had generated a backlog in orders, which meant that Apple booked all the sales in the third quarter last year. If production had not been halted a big chunk of those sales would have shown up in the prior quarter. Apple’s sales reflect its more traditional patterns this year, though the market share gains remain visible. All three analysts see Apple as holding around 10 percent of the computer market, which reflects continued gains.

None of this should be news to investors.

Speaking during the most recent fiscal call, Apple CFO Luca Maestri warned that Mac sales in its September quarter (which it will report next) would be impacted by these statistical anomalies.

“We expect the revenue for both Mac and iPad to decline by double digits year-over-year due to difficult compares, particularly on the Mac,” he said, explaining: “You remember that a year ago in the June quarter, we had factory shutdowns for both Mac and iPad, and so we were able to fill the pent-up demand from those shutdowns during the September quarter.”

The charts

T

Will the enterprise upgrade to Mac?

PC makers may draw good vibes that IDC, Gartner, and Canalys also see some recovery coming to the PC market. Gartner sees 4.9% growth,

While they concede sales fell by around 10% in the period (which implies Apple accounts for a bigger chunk of the market than we thought), they cite increased seasonal demand from the education market and better inventory management by manufacturers.

Apple may still stand to make further gains, of course.

One of the growth catalysts noted by the analysts is the looming PC replacement cycle as Windows machines hit EOL. “The good news for PC vendors is that that the worst could be over by the end of 2023,” said Gartner. “The business PC market is ready for the next replacement cycle, driven by the Windows 11 upgrades. Consumer PC demand should also begin to recover as PCs purchased during the pandemic are entering the early stages of a refresh cycle.”

Apple may well secure some upgrade sales, driven by incoming employee choice and PC replacement schemes.

“After a tough start to the year, the third quarter of 2023 brought about more positive signs for the global PC market,” said Ishan Dutt, Principal Analyst at Canalys.

“Looking ahead, Canalys expects this positive trend to continue, with the market set for a return to growth during the highly anticipated holiday season.”

But will the growth be evenly spread, or will Apple’s soon to debut M3 chips boost Mac sales from next year’s spring season? We’ll know in a few months.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.