Tim Cook hints Apple Card, Apple Pay expansion plans

Image c/o blocks on Unsplash

Apple kept to its current habit of announcing yet another record-setting quarterly result as it opened 2022, ushering in new OS betas and revealing big stats such as now having 785 million services subscribers.

But, hidden among all of this sat a couple of thought-provoking statements from CEO, Tim Cook.

Apple Pay and Apple Card for growth

He was asked where he saw the biggest opportunities for growth – not so much in product or future product terms, but where he saw space for expanding current solutions.

And Cook picked Apple Card and Apple Pay.

Why did he pick them?

What Cook said follows:

“Well, putting aside any kind of thing that sits on our road map for a second in that area, which we obviously wouldn’t talk about in the call, I would say that I think Apple Card has a great runway ahead of us. It was rated to the No. 1 midsized credit carding customer set by J.D. Power and is getting — has fast become people’s main credit card for many, many people.

“And the growth of Apple Pay has just been stunning. It’s been absolutely stunning. And there’s still obviously a lot more there to go — and because there’s still a lot of cash in the environment. And so I think that both of these and whatever else we might do have a great future ahead.”

I don’t think the phrase “whatever else we might do,” related to anything other than Apple Pay/Card, in part because it’s so obvious Apple does other things too.

Apple Card makes debt more fun

In other words, while saying nothing, Cook was flagging up some planned changes and expansions to both services.

Now, I don’t think Cook flags anything up until it hits a relatively critical point of its road map. I don’t think this is about health or VR/AR, when Cook makes big promises but we know the company sits on a longer road.

So, this is a shorter road.

That means Apple plans some form of expansion in Apple Pay and Apple Card and plans to introduce it relatively soon.

What it might introduce is relatively easy to speculate on – which may also mean it has other or additional plans that are harder to guess. But here are some relatively easy to imagine moves the company could make:

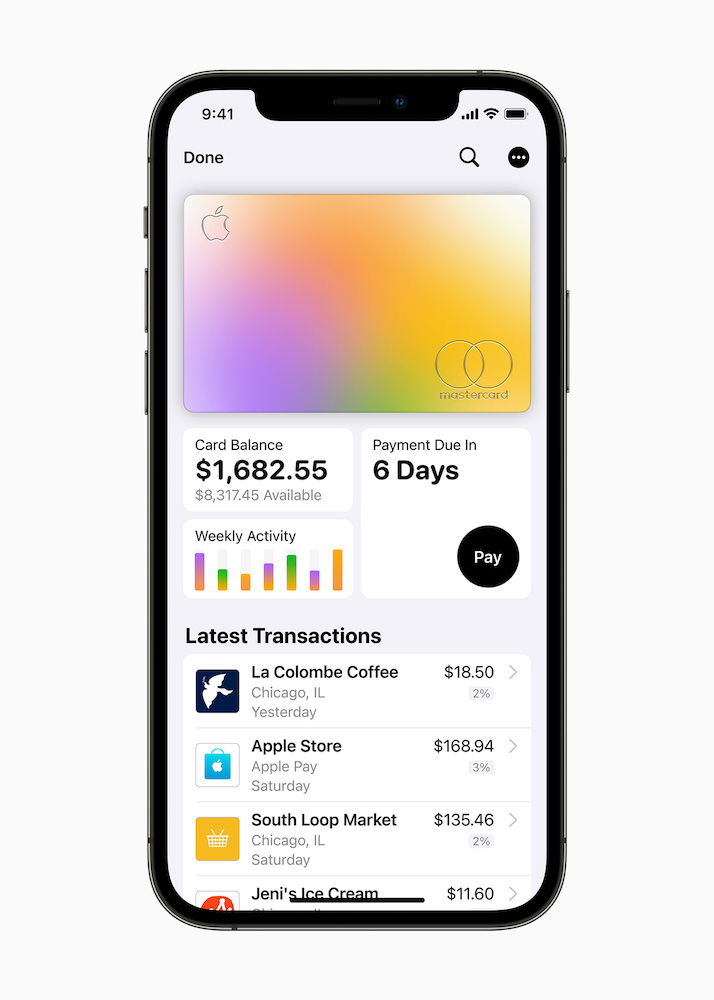

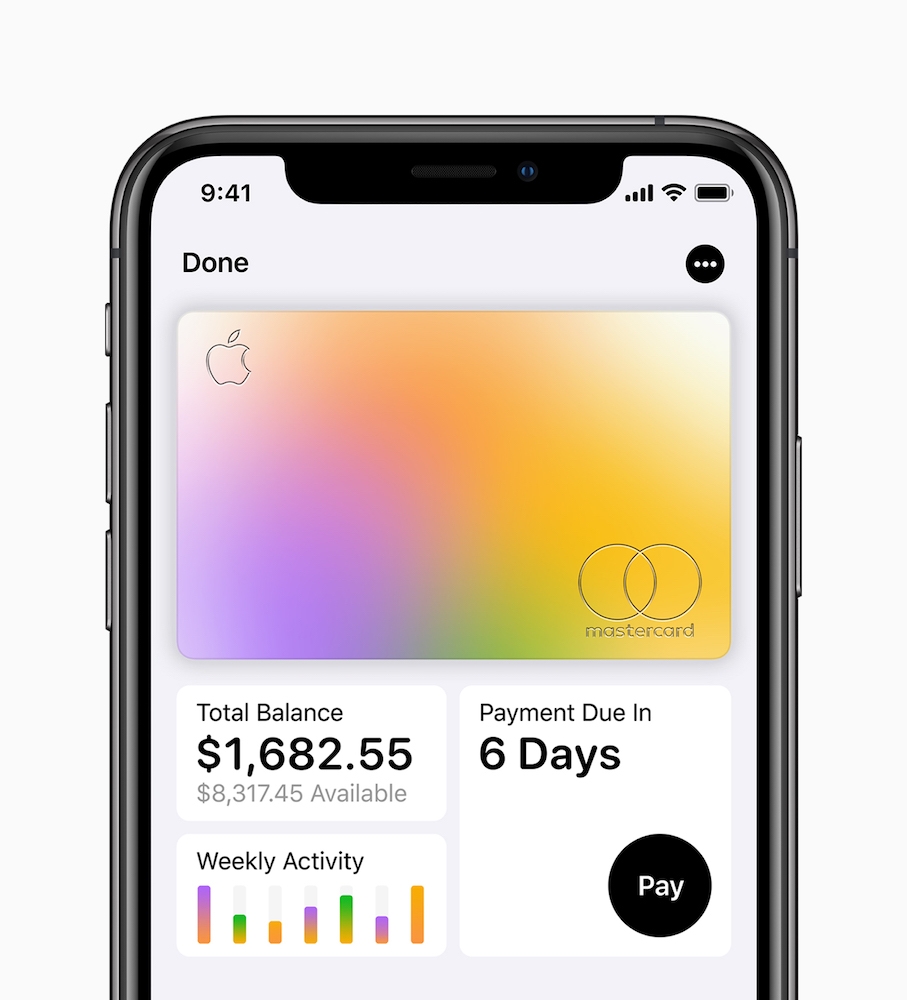

The Apple Card app tries to put you in control…

Expand Apple Pay Cash outside the U.S.

This really has to happen. It needs to happen not just because the non-appearance is a little embarrassing (we’ve been waiting for it now longer than we waited for iTunes to leave the US), but also because doing so is an essential component to the next speculation.

Expand Apple Card outside the U.S.

Apple has a winning hand to play if it manages to figure out how to expand Apple Card to territories outside of the U.S. Cook’s already pointed that advantage out. “It was rated to the No. 1 midsized credit carding customer set by J.D. Power.” By reputation and as he also mentioned by use, Apple Card has a great story to tell as and when it is made available in new nations. It seems possible securing the right partner may be the obstacle here – but perhaps current U.S. partner Goldman Sachs has a plan? One part of that plan must surely include Apple Pay Cash, as that’s the currency the company uses for Apple Daily Cash in the card. We’ve anticipated Apple Card outside the US for years.

Introduce Apple Pay BNPL schemes

We’ve heard whispers of speculation Apple may introduce ‘Buy Now Pay Later’ schemes within Apple Pay. If this works as other such systems do, consumers will be able to purchase items and pay over specific time slots interest-free, or with interest if they must revise those payments. This is an obvious business the company could be in.

Like Apple Pay for credit…

iPhone as Payment Terminals

This recent speculation also makes sense. Apple will find a way to take a slice of the transaction. This may be only a tiny slice, but it will – or it will create frameworks others can use to build their business on its platforms.

[Also read: How to export Apple Card transactions to CSV, OFX, QFX, QBO and PDF]

The Apple MO: Service iteration

Apple Pay and Apple Card aren’t just financial systems, they’re also services, which means they are Apple products. So, like every Apple product, they have development road maps, additional features to be introduced over time, apps that can be improved and tweaked.

- Express Transit can be extended to additional nations;

- It may figure out how to unlock its NFC system to permit third party payment services on its platforms (for a tiny fee);

- Apple may find more effective ways to work with retailer loyalty schemes;

- The company could follow Revolut’s lead and introduce unique additional services such as travel insurance as paid for benefits for Apple Pay users.

- Last year it introduced Apple Card Family.

All of these moves can increase adoption, use and profitability.

Will they or won’t they?

There’s plenty of growth opportunity

Apple sees plenty of growing room for Apple Pay because that space exists.

After all, as of Feb 2020 Apple Pay accounted for 5% of global card transactions, which leaves 95% left to reach. With Apple now holding 785 million subscribers, each one of those may potentially be upsold to using Apple Pay or Apple Card. As of summer 2021, Loup Ventures estimates around half a billion people now use Apple Pay

It is perhaps suggestive of the kind of growth and expansion Apple may already have planned that it recently increased the size of a London-based office space that I think currently holds the Apple Pay team.

Could the company have something coming? It may, or may not, be relevant that Apple introduced Apple Card in March 2019. The service is now almost three years old. I think Mr. Cook quietly flagged a product refresh. It will be interesting to see what they come up with.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.