Transcript: Apple Q3 2023 financial announcements

Apple held the line with some bright spots

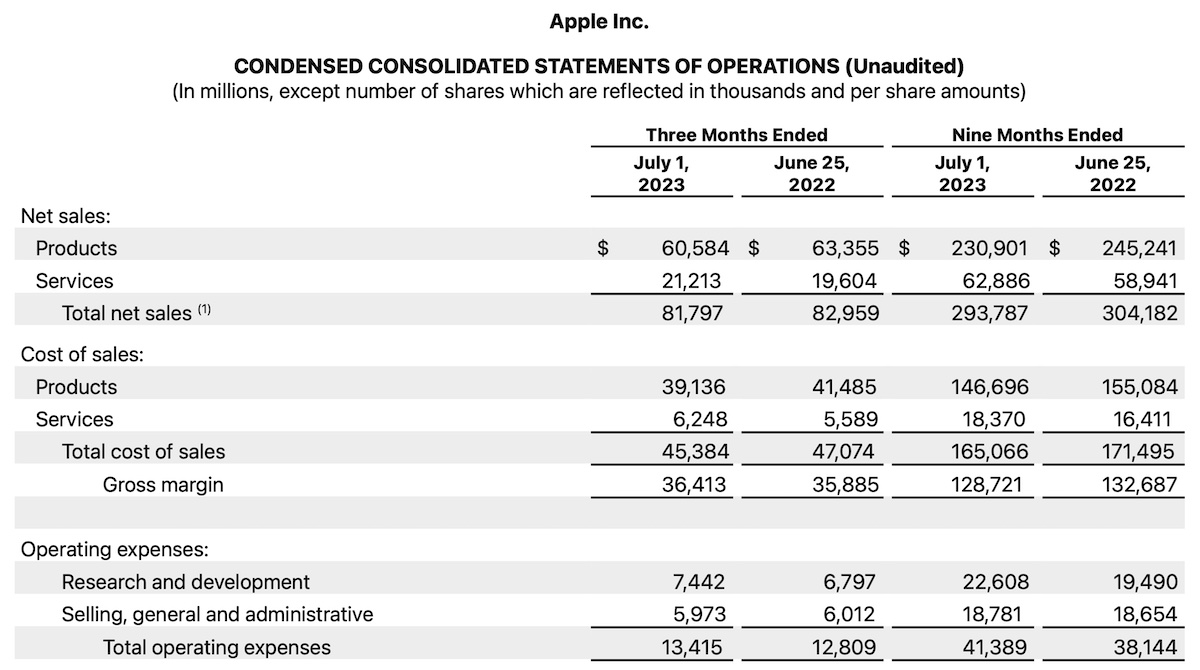

In Q3, 23, Apple posted quarterly revenue of $81.8 billion, down 1 percent year over year, and quarterly earnings per diluted share of $1.26, up 5 percent year over year. Services revenue and installed bases reached all-time records. What follows is a lightly edited transcript of conversation with analysts.

What Apple said

Apple CEO, Tim Cook:

“Good afternoon, everyone, and thanks for joining us.

“Today, Apple is reporting revenue of $81.8 billion for the June quarter, better than our expectations.

“We continue to see strong results in emerging markets, driven by robust sales of iPhone, with June quarter total revenue records in India, Indonesia, Mexico, the Philippines, Poland, Saudi Arabia, Turkey, and the UAE.

“We set June quarter records in a number of other countries as well, including France, the Netherlands, and Austria.

“And we set an all-time revenue record in services driven by more than one billion paid subscriptions.”

Read our previous financial call transcripts at these links:

· Transcript of Apple’s Q2 FY 2023 financial results call

· Apple Q1 FT 2023 financial call transcript

· Apple Q3 FY 22 investor meeting transcript

· Just another Apple Q1 FY2021 earnings call transcript

“We continue to face an uneven macroeconomic environment, including nearly 4 percentage points of foreign exchange headwinds.

“On a constant currency basis, we grew compared to the prior year’s quarter in aggregate and in the majority of markets we track.

“We continue to manage deliberately and innovate relentlessly, and we are driven by the sense of possibility those efforts inspire.”

On the road to Vision Pro

Tim Cook:

“To that end, before I turn to the quarter in more detail, I want to take a moment to acknowledge the unprecedented innovations we were proud to announce at our Worldwide Developers Conference.

“In addition to extraordinary new Macs and incredible updates to our software platforms, we had the chance to introduce the world to spatial computing.

“We were so pleased to share the revolutionary Apple Vision Pro with the world, a bold new product unlike anything else created before.

“Apple Vision Pro is a marvel of engineering, built on decades of innovation, only possible at Apple.

“It is the most advanced personal electronic device ever created, and we’ve been thrilled by the reaction from press, analysts, developers, and content creators who’ve had the chance to try it.

“We can’t wait to get it into customers’ hands early next year.”

Quarter by the numbers

Apple CEO, Tim Cook:

“Now let me share more with you on our June quarter results beginning with iPhone.

“iPhone revenue came in at $39.7 billion for the quarter down 2% from the year ago quarter’s record performance.

“On a constant currency basis, iPhone revenue grew, and we had a June quarter record for switchers reflecting the popularity of the iPhone line-up.

“iPhone 14 customers continue to praise the exceptional battery life and essential health and safety features while iPhone 14 plus users are loving the new larger screen size.

“And with Dynamic Island always on display, and the most powerful camera system ever in an iPhone, the iPhone 14 Pro line up is our best ever.

“Turning to Mac, we recorded 6.8 billion in revenue down 7% year over year.

“We are proud to have completed the transition of our entire Mac line up to run exclusively on Apple Silicon.

“We are also excited to have introduced the new 15-inch MacBook Air during the quarter, the world’s best 15-inch laptop, and one of the best Macs we’ve ever made.”

These are superb machines, read my review here.

“And we launched two new powerhouses in computing, Mac Studio with M2 Macs and M2 Ultra, and Mac Pro with M2 Ultra, which are the most powerful Macs we’ve ever made.

“iPad revenue was $5.8 billion for the June quarter, down 20% year over year, in part due to a difficult compare because of the timing of the iPad Air launch last year.

“Customers are loving iPad’s versatility and exceptional value.

“There was a great deal of excitement from creatives when we brought Final Cut Pro and Logic Pro to iPad this spring.

“And with the back-to-school season in full swing, iPad has the power to help students tackle the toughest assignments.

“Across wearables home and accessories, revenue is $8.3 billion, up 2% year-over-year and in line with our expectations.

“Packed with features to empower users to live a healthier life, Apple Watch and Apple Watch Ultra continue to help people take the next step on their wellness journey.”

Looking to WWDC

Apple CEO, Tim Cook:

“As I mentioned earlier, last quarter we held our biggest and most exciting WWDC yet.

“We were thrilled to welcome developers from across the globe to Apple Park both in person and virtually and to share some stunning new announcements with the world.

“In addition to Apple Vision Pro and the new Macs that we introduced; we had the chance to reveal some truly remarkable new innovations to our software platforms.

“From exciting new features like Live Voice Mail and standby in iOS 17 to new tools for users to work, play, and personalize their experience in macOS Sonoma and iPad OS 17.

“To a fresh design and new workout capabilities in watch OS 10, there’s so much coming later this year to empower users to get more out of their devices and we think they’re going to instantly love these new features.

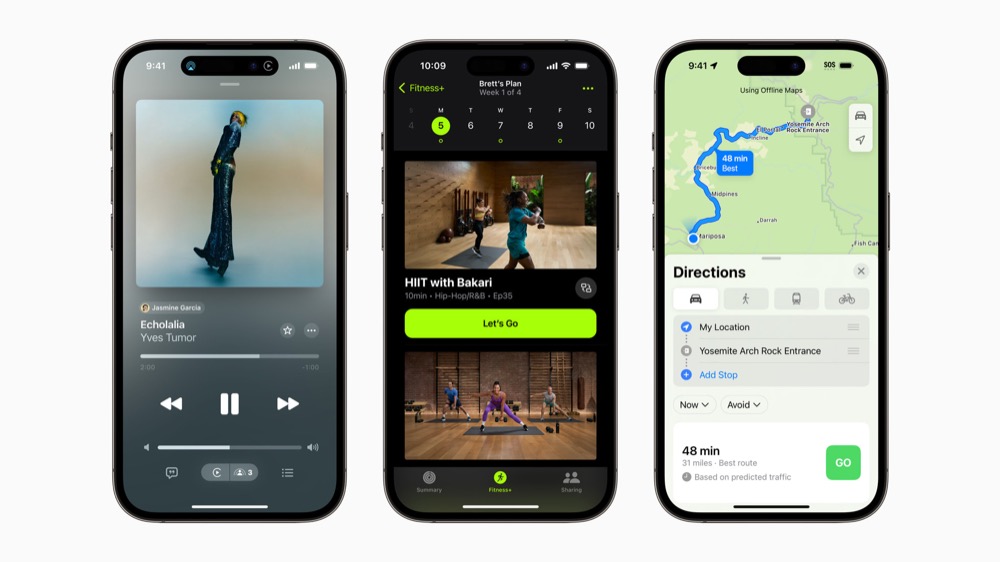

On services

Apple CEO, Tim Cook:

“It was also an exciting quarter for services where revenue reached $21.2 billion and saw a sequential acceleration to an 8% year-to-year increase better than we expected.

“We set an all-time revenue record for total services and in a number of categories, including video, Apple Care, iCloud, and payment services.

“Since we introduced Apple Pay almost a decade ago, customers have been loving how easy it it is to make purchases online, in apps, and in stores.

“We’re also pleased to see Apple Card build on the success of Apple Pay.

“Designed by our user’s financial health in mind, Apple Card has become one of the most successful credit card programs in the US with award winning customer satisfaction.

“In the spring, we introduced a new high yield savings account for Apple Card customers, which has become incredibly popular with customers already making more than $10 billion in deposits.

“Meanwhile, Apple TV Plus continues to provide a spectacular showcase of imaginative storytelling.

“Recently fans welcomed new series like Hijack and Silo, as well as returning fan favorites like Foundation and the After Party.

“In the few years since its launch, Apple TV+ has earned more than 1500 nominations and 370 wins.

“That includes the 54 Emmy Award nominations across 13 titles that Apple TV+ received last month.

“It’s also been an exciting time for sports on Apple TV+.

“Soccer legend Lionel Messi made his debut with Major League Soccer last month and fans all over the world tuned in with MLS season pass.

“We are excited about our MLS partnership, and we’re thrilled to see Messi suiting up with Inter Miami.

“And just in time for summer concert season, Apple Music launched new discovery features celebrating live music, including venue guides in Apple Maps, and set lists from tours of major artists.

“These new features and others join a line up of updates coming later this year to make services more powerful, more useful, and more fun than ever.

Crowds came to the opening

On Apple Retail

Apple CEO, Tim Cook:

“Everything we do is in service of our customers and retail is where we bring the best of Apple.

“During the quarter we open the Apple Store online in Vietnam and we’re excited to connect with more customers there.

“We also redesigned our first ever Apple store located in Tyson’s corner, Northern Virginia, with inclusive, innovative, and sustainable design enhancements.

“We opened a beautiful new store beneath our new London headquarters and the historic Battersea Power Station.

“And the performance of the stores we opened in India this spring exceeded our initial expectations.

“With every product we create, every feature we develop, and every interaction we share with our customers, we lead with the values we stand for.

“We believe in creating technology that serves all of humanity, which is why accessibility has always been a core value that we embed in everything we do.”

Apple’s WWDC developer microsite has a lovely accessibility touch

Accessibility, Privacy & CSR

Apple CEO, Tim Cook:

“On Global Accessibility Awareness Day, we unveil some extraordinary new tools for cognitive, vision, hearing and mobile accessibility that will be available later this year, including assistive access, which distils apps to their most essential features and personal voice, which allows users to create a synthesized voice that sounds just like them.

“Building technology and service for our customers also means protecting their privacy, which we believe is a fundamental human right.

“That’s why we were pleased to announce major updates to Safari private browsing, communication safety, and lockdown mode to further safeguard our users.

“And as part of our efforts to build a better world, we announced that we’ve more than doubled our initial commitment to our racial equity and justice initiative to more than $200 million.

“We will continue to do our part to support education, economic empowerment, and criminal justice reform work.

“And while supporting efforts to advance equity and opportunity, we continue to build a culture of belonging at Apple and a workforce that reflects the communities we serve.

“Through our environmental work, we’re making strides in our commitment to leave the world better than we found it.

“Last month, Apple joined with global non-profit *** and a new effort to improve livelihoods in India through clean energy innovation and we are as committed as ever to our Apple 2030 goal to be carbon neutral across our entire supply chain and the life cycle of our products.

Apple Learning Coach expands to 12 more nations this year

Apple CEO, Tim Cook:

“We’ve long held that education is the great equalizer.

“With that in mind, we’re expanding Apple Learning Coach, a free professional learning program that teaches educators how to get more out of Apple technology in the classroom. Today we welcome more than 1,900 educators across the U.S. to the program. By the end of the year we’ll offer Apple Learning Coach in 12 more countries.

“As we’re connecting with teachers, we’re also celebrating the graduations of students at our app developer academies around the world. From Detroit to Naples to Riyadh and more, we’re excited to watch these talented developers embark on careers in coding and find ways to make a positive difference in their communities.

“Apple remains a champion of innovation, a company fuelled by boundless creativity, driven by a deep sense of mission, and guided by the unshakable belief that a great idea can change the world.

“Looking ahead, we’ll continue to manage for the long term, always pushing the limits of what’s possible and always putting the customer at the center of everything we do.”

“With that, I’ll turn it over to Luca.”

Revenue down 1%, better than expected

Apple CFO, Luca Maestri

“Thank you, Tim, and good afternoon, everyone.

“Revenue for the June quarter was $81.8 billion, down 1% from last year and better than our expectations, despite nearly 4 percentage points of negative impact from foreign exchange.

“On a constant currency basis, our revenue grew year-over-year in total and in the majority of the markets we track.

“We set June quarter records in both Europe and Greater China and continue to see strong performance across our emerging markets driven by iPhone. iPhone revenue was $60.6 billion down 4% from last year as we faced FX headwinds and an uneven macroeconomic environment.

“However, our installed base reached an all-time high across all geographic segments driven by a June quarter record for iPhone switchers and high “new to” rates in Mac, iPad and Watch coupled with very high levels of customer satisfaction and loyalty.

“Our services revenue said an all-time record of $21.2 billion, up 8% year over year and grew double digits in constant currency.

“Our performance was strong around the world as we reached all-time services revenue records in Americas and Europe and June quarter records in Greater China and rest of Asia Pacific.

“Company gross margin was 44.5%, a record level for the June quarter and up 20 basis points sequentially, driven by cost savings and favorable mix shift towards services, partially offset by a seasonal loss of leverage.

“Products gross margin was 35.4%, down 130 basis points from last quarter, due to seasonal loss of leverage and mix, partially offset by favorable costs.

“Services gross margin was 70.5%, decreasing 50 basis points sequentially.

“Operating expenses of $13.4 billion were below the low end of the guidance range we provided at the beginning of the quarter and decelerated from the March quarter.”

On managing spending

CFO, Luca Maestri:

“We continue to take a deliberate approach in managing our spend, with strong focus on innovation and new product development.

“The results of these actions delivered net income of $19.9 billion, diluted earnings per share of $1.26 up 5% versus last year and very strong operating cash flow of $26.4 billion.

“Let me now provide more detail for each of our revenue categories.

iPhone detail

LM: “iPhone revenue was $39.7 billion down 2% year over year but grew on a constant currency basis.

“We set revenue records in several markets around the world, including an all-time record in India and June quarter records in Latin America, the Middle East and Africa, Indonesia, the Philippines, Italy, the Netherlands, and the UK.

“Our iPhone Active install base grew to a new all-time high thanks to June quarter records in switches.

“This is a testament to our extremely high levels of customer satisfaction, which 451 Research recently measured 98% for the iPhone 14 family in the US.”

Mac details

LM: “Mac generated $6.8 billion in revenue, down 7% year over year. We continue to invest in our Mac portfolio, and this past quarter we were pleased to complete the transition to Apple Silicon for the entire lin eup.

“This transition has driven both strong upgrade activity and a high number of new customers. In fact, almost half of Mac buyers during the quarter were new to the product.

“We also saw reported customer satisfaction of 96% for Mac in the US.

iPad details

LM: “iPad revenue was $5.8 billion down 20% year-over-year and in line with our expectations.

“These results were driven by a difficult compare against the full quarter impact of the iPad Air launch in the prior year. At the same time, we continue to attract a large number of new customers to the iPad install base, with over half of the customers who purchased iPads during the quarter being new to the product.

“And the latest reports from 451 Research indicate customer satisfaction of 96% in the US.

Wearables, Home, and Accessories

LM: “Wearables, Home, and Accessories revenue was $8.3 billion, up 2% year over year with a June quarter record in Greater China and strong performance in several emerging markets.

“We continue to see Apple Watch expand its reach, with about two-thirds of customers purchasing an Apple Watch during the quarter being new to the product.

“And this is combined with very high levels of customer satisfaction, which was recently reported at 98% in the United States.

Services

LM: “Moving on to Services, we reached a new all-time revenue record of $21.2 billion, with year-over-year growth accelerating sequentially to 8% and up double digits in constant currency.

“In addition to the all-time records Tim (Cook) mentioned earlier, we also set June quarter records for advertising, app store and music.

“We are very pleased with our performance in services which is a direct reflection of our ecosystem strength.

“First our install base of over two billion active devices continues to grow at a nice pace and establishes a solid foundation for the future expansion of our ecosystem.

“Second, we see increased customer engagement with our services.

“Both our transacting accounts and paid accounts grew double digits year over year, each reaching a new all-time high.

“Third, our paid subscriptions showed strong growth.

“This past quarter, we reached an important milestone and passed 1 billion paid subscriptions across the services on our platform.

“Up 150 million during the last 12 months, and we nearly doubled the number of paid subscriptions we had only three years ago.

“And finally, we continue to improve the breadth and the quality of our current services. From 20 new games on Apple Arcade, to brand new content on Apple TV Plus, to the launch of our high-yield savings account with Apple Card. Our customers are loving these enhanced offerings.”

Apple and the enterprise

Apple CFO, Luca Maestri

“Turning to the enterprise market, our customers are leveraging Apple products every day to help improve productivity and attract talent.

“Blackstone, a global investment management firm, is expanding its Apple footprint from their corporate iPhone fleet to now offering the MacBook Air powered by M2 to all of their corporate employees and portfolio companies.

“Gilead, a leading biopharmaceutical company, has deployed thousands of iPads globally to their sales team.

“Over the last six months, they have also doubled their Mac user base by making MacBook Air available to more employees with a focus on user experience and strong security.

Apple’s cash position

Apple CFO, Luca Maestri

“Let me now turn to our cash position and capital return program. We ended the quarter with over $166 billion in cash and marketable securities. We repaid $7.5 billion in maturing debt while issuing $5.2 billion of new debt and increasing commercial paper by $2 billion, leaving us with total debt of $109 billion. As a result, net cash was $57 billion at the end of the quarter.

“During the quarter, we returned over $24 billion to shareholders, including $3.8 billion in dividends and equivalents, and $18 billion through open market repurchases of 103 million Apple shares.

“We continue to believe there is great value in our stock and maintain our target of reaching a net cash neutral position over time.

Forward outlook

Apple CFO, Luca Maestri:

“As we move ahead into the September quarter, I’d like to review our outlook, which includes the types of forward-looking information … referred to at the beginning of the call.

“We expect our September quarter year-over-year revenue performance to be similar to the June quarter, assuming that the macroeconomic outlook doesn’t worsen from what we are projecting today for the current quarter.

“Foreign exchange will continue to be a headwind, and we expect a negative year-over-year revenue impact of over two percentage points.

“We expect iPhone and services year-over-year performance to accelerate from the June quarter.

“Also, we expect the revenue for both Mac and iPad to decline by double digits year-over-year due to difficult compares, particularly on the Mac.

“For both products, we experienced supply disruptions from factory shutdowns in the June quarter a year ago and were able to fulfil significant pent-up demand in the year-ago September quarter.

“We expect gross margin to be between 44 and 45%.

“We expect OPEX to be between $13.5 and $13.7 billion.

“We expect OENE to be around negative $250 million, excluding any potential impact from the market to the market of minority investments, and our tax rate to be around 16%.

“Finally, today our board of directors has declared a cash dividend of $0.24 per share of common stock payable on August 17, 2023 to shareholders of record as of August 14, 2023.”

Analyst questions

Q: Shannon Cross, Credit Suisse

“You mentioned an uneven macro environment during the quarter several times on the call. I’m wondering if you can talk on a geographic basis about some of the trends you’re seeing in iPhone. I’m specifically wondering how demand is trending within…” (Caller line dropped).

A: Apple CFO, Luca Maestri

“On a geographic basis, we’ve had great performance for iPhone in emerging markets. We set June quarter records in many of the emerging markets. We grew in total double digits, and the performance was strong across the board in emerging markets from China, where our performance improved from minus 3 percent to plus 8 percent in the June quarter.

“We grew double digits in constant currency to many other areas around the world from India, where again we set a June quarter record with very strong performance there.

“Indonesia, Southeast Asia in general, Latin America, Middle East, and so it’s been really good there.

“We also, as you can see from our geographic segments, we had a slight acceleration of performance in the Americas, primarily in the United States.

“We declined there because the smartphone market has been in a decline for the last couple quarters in the United States.”

Q: Shannon Cross, Credit Suisse

“Thank you very much. Sorry about that. I’m not sure why I cut off.

“In terms of gross margin, you are high end of the range and you just, you guided the 45% of the high end, which is, you know, I think higher than I remember in 20 years of covering you.

“So how should we think about puts and takes of gross margin and, you know, what it seems like there’s like a perfect storm of good things.

“So, I just maybe if you can talk about how you’re thinking about it more holistically.

A: Apple CFO, Luca Maestri

“I think you remember correctly, Shannon, because the 44.5% for the June quarter is an all-time record for us in June. We were up 20 basis points sequentially.

“It was driven by cost savings and a mixed shift towards services, which obviously helps company growth margins partially offset by the seasonal loss of leverage.

“We have a commodity environment that is favorable to us. Our product mix is quite strong at this point. And so, with the exception of foreign exchange, we continue to be a drag, and it was a significant drag on a year-over-year basis.

We are in a good position right now. We are in a good position for the June quarter. And as I mentioned, we expect similar level of gross margins for the same reasons, frankly, for the September quarter.”

Q: Wansu Mohan, Bank of America:

“Luca, can you just, it gives a little more color around the guidance, your overall revenue performance, you called out similar, obviously you absorbed a higher FX impact this quarter versus your guide, and you also noted services acceleration.

“So just wondering, you know, when you think about that comment on iPhone acceleration, is that on a reported basis, is that constant currency basis?

“And is there something that’s changing in terms of seasonality perhaps for you that is causing not as much step up in product revenue as typical on a sequential basis?”

A: Apple CFO, Luca Maestri

“So, all our comments are in reported currency, not in constant currency in relation to the outlook. And we said acceleration sequentially for iPhone and for services.

“But we also pointed out — and this is where I think once you’re referring to some seasonality issues — we also said that for Mac and iPad, we expect to decline double digits. And the reason for that is that we have a very difficult compare versus last year.

“You remember that a year ago in the June quarter, we had factory shutdowns for both Mac and iPad, and so we were able to fill the pent-up demand from those shutdowns during the September quarter.

“So, an unusual level of activity that we had a year ago, and so now obviously the compare is difficult, so we expect both iPad and Mac to be down double digits, which offset the acceleration that I mentioned for iPhone and services.”

Q: Wansu Mohan, Bank of America:

“Okay, thank you, Luca. And, Tim (Cook), I was wondering if you could update us on what percent of iPhones are sold on some type of instalment basis now versus full upfront payment on a global basis and maybe some thoughts on if you expect similar promotional activity from carriers especially in the U.S. that seem to be grappling with a lot of cash flow issues this particular year.”

A: Apple CFO, Luca Maestri

“We’ve done a really good job over the last few years with affordability programs around the world directly in our direct channel and with our partners around the world.

“The majority of iPhones at this point are sold using some kind of a program, trade-ins, instalments, some kind of financing. And that percentage, which again it’s well over 50%, is very similar across developed and emerging markets.

“We want to do more of that because we think it really helps reduce the affordability threshold for our products and we think it is also one of the reasons why our product mix has been very strong during the last couple of cycles.

“So, we will continue to push on that front.”

Q: David Vogt with UBS

“I just wanted to follow up on two points that both you, Tim, and Luca made about growth and maybe commodities. So just to be clear, I know you’re talking about an acceleration in iPhone, but the comp. is about two-point easier from FX.

“So just want to understand, is that on a like for like basis, excluding the currency improvement of about two points from the June quarter to the September quarter?

“And from a commodity perspective, I know last quarter you talked about buying a lot of inventory at favorable prices, which was, you know, an incredibly smart strategy. Where do you sit today and what’s sort of the timing or the duration of that commodity sort of backlog that you have as we think about next quarter and the subsequent quarters?

“How far does that get you out into the future from the favorable cost dynamic?”

A: Apple CFO, Luca Maestri

“Let me start again. I just want to be clear about the guidance, the output guidance that we’ve provided. We’re referring entirely to reported numbers.

“So, they take into account the fact that we have a slight improvement in foreign exchange. So, when I talk about similar performance, I refer to reported performance in the June quarter and then the reported performance in the September quarter.

“And again, we expect on a reported basis, our iPhone performance to accelerate, our services performance to accelerate, and iPad and Mac to decline double digits.

“On the commodity front, as I mentioned, the environment is favorable. We always make sure that we take advantage of the opportunities that are available in the market and we will continue to do that going forward.

Q: David Vogt with UBS

“Luca, any sense on how long that gives you a runway today based on what you currently have? Do you have a sense for at least the short term tail end?

A: Apple CFO, Luca Maestri

“I don’t want to speculate past the September quarter because that’s the horizon where we provide guidance and I’ve said that the guidance for September is 44 to 45, which you know is historically very high. And so obviously, that reflects a favorable environment for us.”

Q: Eric Woodring with Morgan Stanley.

“Maybe if we just start, kind of big picture, you know, Tim or Luca, I was wondering if you could just kind of share some incremental color on how you think the consumer is behaving today versus 90 days ago and maybe how that differs by region, meaning are there any signs that consumers incrementally more willing to spend on things like consumer electronics or is there still relative caution in the market?

“Are there any regions where you’re seeing more strength in the consumer and how sustainable do you think some of that strength or weakness could be based on some of the KPIs you track?

“And then I will follow up.”

A: Apple CEO, Tim Cook

“Hi, David. It’s Tim. If you sort of step around the world, we did exceptionally well in emerging markets last quarter and even better on a constant currency basis. So emerging markets were a strength.

“If you look at China – in China, we went from a negative three in Q2 to a plus eight in Q3. And so, in China, we had an acceleration.

“If you look at the U.S., which is in the – obviously in America’s segment, it is the vast majority of what’s in there. There was also a slight acceleration sequentially, although the Americas is still declining somewhat year-over-year, as you can see on the data sheet. The primary reason for that is that it’s a challenging smartphone market in the U.S. currently.

“And then in Europe, Europe saw a record June quarter. And so some really good, really good signs in most places in the world.”

Q: Eric Woodring with Morgan Stanley.

“And then, you know, maybe, Luca, a question for you. I think it’s been about three quarters now where we’ve seen OpEx either grow below historical seasonality or come in below your expectations. I think this was the first time we’ve seen R&D grow less than 10% year over year since fiscal 2Q 2007.

“So, can you maybe just talk about some of the cost actions you’re taking and as you look forward, what are the indicators that you’re really evaluating that would give you greater confidence in perhaps returning back to a more seasonal cadence of OpEx spending? Or is this just a new normal that we should be expecting?”

A: Apple CFO, Luca Maestri

“Well, obviously, obviously we look at the environment and we know that this has been an uncertain period for the last few quarters and so we decided to be deliberate in what we do in terms of controlling our spend and there’s many areas across the company that we’re working on and we’ve been quite effective as slowing down the spend.

“We slowed down also the hiring within the company in several areas and we’re very pleased with our ability to decelerate some of the expense growth, considering the overall macro situation.

“We will continue to manage, you know, deliberately.

“You can see that we continue to grow our R&D costs faster than the rest of the company as GNA is actually growing at a much slower pace because obviously our focus continues to be in innovation and product development and we continue to do that.”

Q: Michael Ng with Goldman Sachs.

“I just have two questions as well. First, it was encouraging to see the services outperformance in the quarter, you know, up double digits on an FX neutral basis and more services acceleration next quarter on a reported basis.

“I was just wondering if you could just talk a little bit more about, you know, key underlying drivers for the confidence in services acceleration next quarter, you know, understand the FXE’s a little bit.

“But, you know, anything to call out as it relates to, you know, things in Apple Search Ads that’s helping, you’re obviously making a lot of investments in Apple TV Plus between MLS and the Canal Plus Deal. So, any thoughts there would be great.”

A: Apple CFO, Luca Maestri

“I mean, clearly, we’ve seen an improvement in the June quarter and we expect further improvement in the September quarter. In June, the performance was across the board.

“Tim and I mentioned we set records really across the board. You know, we had all-time records in cloud, in video, in Apple Care, in payments, and June quarter records in app store, advertising, and music.

“So, we saw improvement in all our services categories.

“We think the situation will continue to improve as we go through September.

“And that’s very positive – because not only good for the financial results, but obviously it shows a high level of engagement of our customers in the ecosystem, which is very important for us.

“And it’s really the sum of all the things that I mentioned in my prepared remarks. It goes from the fact that our install base continues to grow. So, we’ve got a larger pool of customers, to the fact that our customers are more engaged. We have more transacting accounts and paid accounts on the ecosystem.

“And the subscriptions business is very healthy with growth of 150 million paid subscriptions just in the last 12 months. It’s almost double to what we had three years ago and of course we are providing more and more content to our users. And so, the combination of all these things gives us good confidence for September.”

Q: Michael Ng with Goldman Sachs.

“And just as a related follow-up, it’s about the hardware installed base and services ARPU. You know, I thought it was curious when you talked about the services strength. You talked about the two billion plus install base.

“When you think about the opportunity to increase the services ARPU, do you really think about it internally on a per active iPhone user basis or on a per device basis?

“You know, said differently, I’m just curious where you think about there’s whether you think there’s an incremental opportunity for, you know, those users that have multiple devices, do you really see a big services ARPU uplift? In that respect, thank you.”

A: Apple CFO, Luca Maestri

“We know that customers that own more than one device are typically more engaged in our ecosystem. And so obviously they tend to also spend more on the services front.

“I would say the biggest opportunity is that we know that there’s a lot of customers that we have that are very familiar with our ecosystem, that are engaged in the ecosystem.

“But still today, they’re using only the portion of the ecosystem that is free. And so, we think that by offering better content and more content over time, we’re going to be able to attract more of them as paid customers.”

Q: Amit Daryanani, Evercore

“I guess, Luca, maybe we can talk about wearables a bit. The growth over there, I think in constant currency is fairly impressive at plus 6%. It’s just touching maybe what’s driving that and then how do we think about the wearables segment heading into the September quarter. I know you talked about a bunch of other ones, but how do we think about wearables in September as well?”

A: Apple CFO, Luca Maestri

“On the wearables front, we had a really good performance in greater China. And that’s, again, very important for us. It was a June quarter record for Greater China. Very important for us because again it shows that the engagement with the ecosystem in a market that is so important for us like China continues to grow. It means that there’s more and more customers that are owning more than the iPhone.

“Also, we continue to grow the install base of the category very quickly because as I mentioned two-thirds of every buyer of Apple Watch during the course of the June quarter was new to the product and so that is all additive to the install base.

“So, you know it’s just you know just great to see. AirPods continue to be a great success in the marketplace for us and so things are moving in the right direction.

“It’s become a very large business for us. In wearables home and accessories in the last 12 months we’ve done $40 billion of business, which is nearly the size of a Fortune 100 company.

“So, it’s become very important and it’s allowed us to diversify both our revenues and our earnings.”

Q: Amit Daryanani, Evercore

“The growth in Europe at up 5% is fairly notable as well. I think you have a few emerging markets that you put in Europe as well. But what’s happening in Europe and is there a way to think about sort of Western Europe or developed world with emerging markets over there?”

A: Apple CFO, Luca Maestri

“Yeah, it’s been very good primarily on the emerging market side of Europe. We include India in the Middle East and Central and Eastern Europe into the Europe segment. But, as we mentioned at the beginning of the call, we had a number of markets that did very well, like France, like Italy, the Netherlands, Austria. So it was a good quarter for Europe.

Q: Harsh Kumar, Piper Sandler:

“Luca, for some time now, for many quarters, you’ve had a currency headwind, a foreign exchange currency headwind. It’s conceivable that as rates start to come down, hopefully next year, that the dollar weakens. Could you take us to the mechanism of how that will work on your revenues and for your costs?”

A: Apple CFO, Luca Maestri

“We try to hedge our foreign exchange exposures because we think that’s the right approach for the company in terms of minimizing the volatility that necessarily happens from the movements of currencies. We cannot effectively hedge every single exposure around the world because in some cases it is not possible, in other cases, it is prohibitively expensive, but we tend to cover all the major currency pairs that we have.

“About 60% of our business is outside the United States, so it’s a very, very large, and I would say very effective, hedging program. And so, we set up these hedges, and they tend to roll over very regularly and then we replace them with new hedges at the new spot rate.

“So, the impact that we’re going to have on revenue and cost will depend on where the spot rates are at different points in time and therefore because of the way the program works, tends to be a bit of a lag in both directions as the foreign exchange moves over time.”

Q: Harsh Kumar, Piper Sandler:

“And for Tim, historically, for the last many years, carriers in at least the U.S., which I think is your largest market for iPhone, have had programs to help folks upgrade, whether they give a cash rebate or you bring in your old phone, something like that. I was curious as you get into your peak December quarter, if you’re aware of these programs are in place. And the reason why I’m asking is I think earlier you mentioned that more than 50% of your phones are sold for some kind of program. I assume the number is even higher in the U.S.”

A: Tim Cook, Apple CEO:

“I don’t want to get into revealing specifics in the different carriers, but generally speaking, I would think that it would be quite easy to find a promotion on a phone provided you’re hooking up to a service and either switching services carriers or upgrading your phone at the same carrier. I think both of those cases today that you can find promotions out there and I would expect that you’d be able to do that in the December time frame as well.”

Q: Aaron Rakers, Wells Fargo:

“I just want to kind of ask Tim Cook strategically as we think about the services growth and kind of the content expansion behind that. I’m curious if you could help us maybe appreciate what you’ve seen from a sporting perspective in terms of the engagement with MLS, of the engagement with Major League Baseball. And how strategically you’re thinking about expansion in sports as a key driver of services growth going forward?”

A: Tim Cook, Apple CEO:

“You know, we’re focused on original content, as you know, with TV Plus. And so, we’re all about giving great storytellers the venue to tell great stories and hopefully get us all to think a little deeper. And sport is a part of that because sport is the ultimate original story. And for MLS, we’re, we could not be happier with how the partnership is going. It’s clearly in the early days. But we are beating our expectation in terms of subscribers and the fact that Messi went to Inter-Miami helped us out there a bit and so we’re very excited about it.”

Q: Aaron Rakers, Wells Fargo:

“And as a quick follow-up, I’m just curious to an update on, you mentioned in your prepared remarks the continued growth that you’ve seen in India. I’m curious how we think about that market opportunity looking forward. Is there anything that you see evolving that could accelerate the opportunity for iPhone in that large mobile market?”

A: Tim Cook, Apple CEO:

“We did hit a June quarter revenue record in India, and we grew strong double digits. We also opened our first two retail stores during the quarter, and it’s – of course, it’s early going currently — but they’re currently beating our expectation in terms of how they’re doing.

“We continue to work on building out the channel and putting more investment in our direct to consumer offers as well.

“And so, I think if you look at it, it’s the second largest smartphone market in the world. And we ought to be doing really well there and where I’m really pleased with our growth there, we still have a very, very modest and low share in the smartphone market. And so, I think that it’s a huge opportunity for us. And we’re putting all of our energies in making that occur.”

Q: Sidney Ho, Deutsche Bank.

“I just wanted to ask about the AI side of things. Your strategy on AI seems quite different than many of your peers. At least you don’t talk too much about that, how much you invest in it. Maybe you can elaborate a little bit on that.

“But related to that, how do you see your investment in this area turning into financial performance in the future? Is it mainly through faster upgrade cycle, maybe higher ESP, or are you thinking about maybe additional services that you can capitalize on that?”

A: Tim Cook, Apple CEO

“If you take a step back, we view AI and machine learning as core fundamental technologies that are integral to virtually every product that we build.

“And so, if you think about WWDC in June, we announced some features that will be coming in iOS 17 this fall, like personal voice and live voicemail.

“Previously, we had announced life-saving features like fall detection and crash detection and ECG.

“None of these features that I just mentioned and many, many more would be possible without AI and machine learning. And so, it’s absolutely critical to us.

“And of course, we’ve been doing research across a wide range of AI technologies, including generative AI for years. We’re going to continue investing and innovating and responsibly advancing our products with these technologies with the goal of enriching people’s lives.

“And so that’s what it’s all about for us.”

“And as you know, we tend to announce things as they come to market. And that’s our M. O. And I’d like to stick to that.”

Q: Sidney Ho, Deutsche Bank.

“I have a follow-up is related to, you talk about WWDC, the way you actually introduced Vision Pro there, clearly a very big announcement there. How should we think about the revenue ramp related to Vision Pro? Is there any catalyst that we should be thinking about that will drive an introduction of that product?”

A: Tim Cook, Apple CEO

“Yeah, there’s enormous excitement around the Vision Pro. We’re excited internally. Everybody that’s been through the demos or are blown away, whether you’re talking about press or analysts or developers.

“We are now shipping units to the developer community for them to begin working on their apps. And we’re looking forward to shipping early next year.

“So, we could not be more excited with it.

“I’m using the product daily. And so, we’re not I got a forecast revenues and so forth on the call today. But we’re very excited about it.”

Q: Krish Sankar, TD Cowen

“Tim, you mentioned about the record number of switchers in the quarter. I’m kind of curious how to think about, you know, given the weak macro and consumer spending, how’s the relacement cycle for iPhone? Is it similar, longer, shorter versus prior years? And can you talk a little bit about the demand linearity of iPhone during the June quarter?”

A: Tim Cook, Apple CEO

“Switchers were a very key part of our iPhone results for the quarter. We did set a record. We set a record in Greater China in particular, and it was at the heart of our results there.

“We continue to try to convince more and more people to switch because of our experience and the ecosystem that we can offer them. And so, I think switching is a huge opportunity for us.

“In terms of the upgrade cycle and so forth, it’s very difficult to estimate real time what is going on with the upgrade cycle. I would say if you think about the iPhone results year over year, you have to think about the iPhone SE announcement in the year ago quarter, and so that provides a bit of a headwind on the on the calm.

“But as as Lucas said, as he talked about how we’re viewing Q4, the September quarter, we see iPhone accelerating in Q4.”

Q: Krish Sankar, TD Cowen

“And then my final question is, on your retail stores, obviously you have a very large retail footprint and many of your stores seem to have been open for over a year now.

“How is the foot traffic there and how do you think about sales or the retail trends in the June quarter and implication for the back half of this year on a seasonality basis?”

A: Tim Cook, Apple CEO

“If you look at retail, it’s a key part of our go-to-market approach. And it will be so key and such a competitive advantage with Vision Pro. It will give us the opportunity to launch a new product and demo to many people in the stores. And so, it has many advantages in it.

“And we continue to roll out more stores, as you know, we just opened two in India last quarter. There’s still a lot of countries out there that don’t have Apple stores that we would like to go into.

“We continue to see it as a key part of how we go to market and love the experience that we can provide customers there.”

Read our previous financial call transcripts at these links:

· Transcript of Apple’s Q2 FY 2023 financial results call

· Apple Q1 FT 2023 financial call transcript

· Apple Q3 FY 22 investor meeting transcript

· Just another Apple Q1 FY2021 earnings call transcript

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.