Transcript: Apple Q4 2023 financial announcements

This quarter was a mixed bag, but still quite a profitable one.

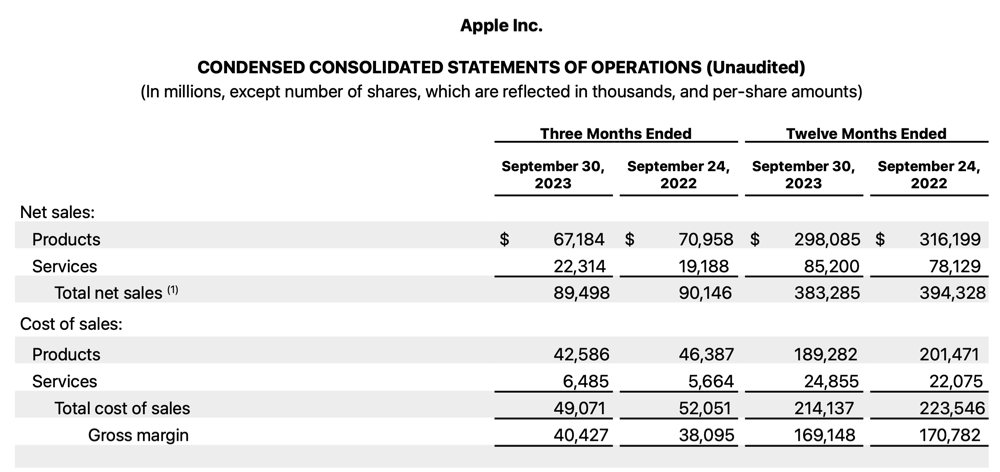

Apple saw Q4 quarterly revenue of $89.5 billion, down 1 percent year over year, and quarterly earnings per diluted share of $1.46, up 13 percent year over year. What follows is a transcript of the financial call, headlines are mine.

The big picture

Today, Apple is reporting revenue of $89.5 billion for the September quarter.

We achieved an all-time revenue record in India as well as September quarter records in several countries, including Brazil, Canada, France, Indonesia, Mexico, the Philippines, Saudi Arabia, Turkey, the UAE, Vietnam, and more.

iPhone revenue came in ahead of our expectations, setting a September quarter record as well as quarterly records in many markets, including China, mainland, Latin America, the Middle East, South Asia, and an all-time record in India.

In services, we set an all-time revenue record with double-digit growth and ahead of our expectations.

During the September quarter, we continue to face an uneven macroeconomic environment, including foreign exchange headwinds, and we’ve navigated these challenges by following the same principles that have always guided us.

We’ve continued to invest in the future and manage for the long term.

We’ve adapted continuously to circumstances beyond our control while being thoughtful and deliberate on spending. And we’ve carved a path of ground-breaking innovations and delivered with excellence every step of the way. That includes Apple Vision Pro, which has gotten such an amazing response from developers who are currently creating truly incredible apps. We’re excited to get this magical product in the hands of customers early next year.

Read our previous financial call transcripts at these links:

- Transcript: Apple Q3 2023 financial announcements

- Transcript of Apple’s Q2 FY 2023 financial results call

- Apple Q1 FT 2023 financial call transcript

- Apple Q3 FY 22 investor meeting transcript

- Just another Apple Q1 FY2021 earnings call transcript

iPhone details

Now let me share more about our products, beginning with iPhone.

iPhone revenue came in at $43.8 billion, 3% higher than a year ago, and a new record for the September quarter.

This fall, we were thrilled to debut the iPhone 15 line-up. The all-new iPhone 15 and iPhone 15 Plus feature a gorgeous design, powerful cameras, and the intuitive dynamic island. Powered by the industry-leading A17 Pro, our iPhone 15 Pro line-up has a beautiful, strong, and durable titanium design and the best iPhone camera system ever, including a 5x telephoto lens on iPhone 15 Pro Max. Customers are loving the entire iPhone 15 family, and reviews have been off the charts.

Mac news

In Mac, revenue came in at $7.6 billion, down 34% year-over-year from the prior year’s record quarter. This was due to challenging market conditions, as well as difficult compares against the supply disruptions and subsequent demand recapture we experienced a year ago. Earlier this week, we were excited to unveil the next generation of Apple Silicon with our incredible family of M3 chips, M3, M3 Pro, and M3 Max. We’re continuing to innovate at a tremendous pace, and our industry-leading line-up of personal computers just got even better. The new MacBook Pro line-up brings our most advanced technology to our Pro users, while iMac, the world’s best-selling all-in-one, just got faster and more capable. And according to the latest data from Student Monitor, nearly two out of three college students chose a Mac. We couldn’t be more excited about the future.

iPad overview

Turning to iPad, revenue for the September quarter was $6.4 billion. iPad sets the goal standard for tablets, and our competitors are unable to match the iPad experience that is enabled by our seamless integration of hardware and software. iPad is also our most versatile product. In classrooms around the world, its helping educators bring lessons to life while giving students a window into the world around them. And in artist workshops, design studios, and everywhere else creative minds come together, iPad supercharges the creative process, helping users take their ideas further than they ever could before.

Wearables and…

Across wearables, home, and accessories, revenue came in at $9.3 billion. Apple Watch has become essential in our lives, and this is our best Apple Watch line-up ever. With Apple Watch Series 9 and Apple Watch Ultra 2, we’re giving people even more tools to stay safe and live healthy, active lives. With a new double-tap gesture, users can easily control Apple Watch Series 9 and Apple Watch Ultra 2 using just one hand and without touching the display. It feels like magic. Our latest Apple Watch line-up also includes our first-ever carbon neutral products, a significant achievement of innovation and determination.

The ecosystem

Apple’s unique ecosystem of hardware, software, and services delivers an unparalleled user experience. During the quarter, we also had the chance to introduce a range of exciting new updates to our software that will allow users to get even more out of their devices. Whether it’s personalized contact posters and new FaceTime features in iOS 17, new tools for users to make their experience their own in macOS Sonoma and iPadOS 17, or a bold new look in watchOS 10 that lets you see and do more faster than ever, Apple is delivering an even better, richer experience that users are loving.

Services

Services revenue set an all-time record of $22.3 billion, a 16% year-over-year increase. We achieved all-time revenue records across App Store, Advertising, Apple Care, iCloud, Payment Services, and Video, as well as a September quarter revenue record in Apple Music. Whether subscribers are waking up to headlines on Apple News Plus, getting their morning workout in with Fitness Plus, feeling the beat with Apple Music on their way to work or school, or unwinding at the end of the day with Apple Arcade, we have so many different services to enrich their day.

On TV

Apple TV Plus continues to delight customers as well, with new and returning shows like The Morning Show, Lessons in Chemistry, and Monarch.

We’re telling impactful stories that inspire imagination and stir the soul. Making movies that make a difference is also at the heart of Apple TV Plus, and we were thrilled to produce Martin Scorsese’s Killers of the Flower Moon, a powerful work of cinema that premiered in theaters around the world last month.

We’re proud to say that since launch, just over four years ago, Apple TV Plus has earned nearly 1,600 award nominations and nearly 400 wins. We also offer subscribers an unprecedented live sports experience with MLS Season Pass.

We couldn’t be more pleased with how our partnership with Major League Soccer has gone in its first year. Subscriptions to MLS Season Pass have exceeded our expectations, and we’re excited to continue that momentum next year. With the playoffs now underway, we can’t wait to see who takes home the MLS Cup.

The retail stores

And nowhere does the magic of Apple come alive more than it does in our stores. Over the past year, we’ve continued to find ways to connect with even more customers. We welcomed customers to our first ever retail locations in India. We also opened doors to new stores in Korea, China, and the UK, and expanded the Apple Store online to Vietnam and Chile. And we have another store opening in China this week. In September, I joined our team at Apple Fifth Avenue on launch day, and the energy and excitement were unbelievable. Every time we connect with a customer, we’re reminded why we do what we do. From simple joys of creating and sharing memories to life-saving features like emergency SOS via satellite, we’re enriching lives in ways large and small.

On CSR

And whether we’re working to safeguard user privacy, ensure technology made by Apple is accessible for everyone, or build an even more inclusive workplace, we’re determined to lead with our values. Our environmental efforts are a great example of the intersection of our work and our values. Across Apple, we act on a simple premise. The best products in the world should be the best products for the world. We’ve made our environmental work a central focus of our innovation because we feel a responsibility to leave the world better than we found it, and because we know that climate change cannot be stopped unless everyone steps up and does their part. Our first ever carbon neutral products represent a major milestone, and we’re going to go even further. We plan to make every product across our line-up carbon neutral by the end of the decade. And we’re not doing it alone. Over 300 of our suppliers have committed to using 100% clean energy for Apple production by 2030.

We also continue to invest in entrepreneurs who are lighting the way for a greener, more equitable future. Through our third impact accelerator class, we’re proud to support a new class of diverse innovators on the cutting edge of green technology and clean energy.

Apple is always looking forward, driven in equal measure by a sense of possibility and a deep belief in our purpose. We’re motivated by the meaningful difference we can make for our customers and keenly determined to push the limits of technology even further. And that’s why I’m so confident that Apple’s future is bright.

With that, I’ll turn it over to Luca.

Luca Maestri, CFO

Thank you, Tim, and good afternoon, everyone.

Revenue for the September quarter was $89.5 billion down less than 1% from last year. Foreign exchange had a negative impact of over 2 percentage points, and on a constant currency basis our revenue grew year over year in total and in each geographic segment. We set a September quarter record in the Americas and saw strong performance across our emerging markets.

Product’s revenue was $67.2 billion down 5% from last year due to very challenging compares on both Mac and iPad, which I will discuss in more detail later on. At the same time, we reached a September quarter record on iPhone driven by strength in emerging markets. Our total install base of active devices reached an all-time high across all products and on geographic segments, thanks to our high levels of customer satisfaction and many new customers joining our ecosystem.

Our services revenue set an all-time record of $22.3 billion up 16% year over year. We grew accelerating sequentially from the June quarter. Our performance in services was broad based.

And we reached all-time revenue records in the Americas, Europe and rest of Asia Pacific and a September quarter record in Greater China, we also set new records in every services category. Company Gross Margin set a September quarter record at 45.2% up 70 basis points sequentially driven by leverage and favorable mix partially offset by foreign exchange. Product’s gross margin was 36.6% up 120 basis points sequentially also driven by leverage and mix partially offset by foreign exchange. Services gross margin was 70.9% up 40 basis points from last quarter due to a different mix.

- Operating expenses of $13.5 billion were at the low end of the guidance range we provided up 2% year over year.

- Net income was $23 billion.

- Diluted earnings per share was $1.46 up 13% versus last year and a September quarter record.

- Operating cash flow was strong at 21.6 billion.

- Let me now provide more detail for each of our revenue categories.

By product category

iPhone revenue was $43.8 billion up 3% year over year and a new September quarter record. We had strong performance in several markets including an all-time record in India and September quarter records in Canada, Latin America, the Middle East, and South Asia.

Our iPhone active install base grew to a new all-time high and fiscal 2023 was another record year for switchers. We continue to see extremely high levels of customer satisfaction which 451 research recently measured at 98% in the US.

Mac revenue was $7.6 billion down 34% year over year driven by challenging market conditions and compounded by a difficult compare in our own business. Whereby last year we experienced supply disruptions from factory shutdowns in the June quarter and we are subsequently able to fulfil significant pent up demand during the September quarter. We had a difference in launch timing with the MacBook Air launching earlier this year in the June quarter compared to the September quarter last year. We have great confidence in our Mac line-up and are excited about the recently announced iMac and MacBook Pro powered by our M3 chips. Our install base is at an all-time high and half of Mac buyers during the quarter were new to the platform, driven by MacBook Air. Also, we saw reported customer satisfaction of 97% for Mac in the US.

iPad generated $6.4 billion in revenue down 10% year over year. Similar to Mac these results were a function of a difficult compare from the supply disruptions in the June quarter a year ago and the subsequent fulfilment of pent up demand in the September quarter. iPad continues to attract a large number of new customers to the install base with over half of the customers who purchased iPads during the quarter being new to the product. And the latest reports from 451 research indicate customer satisfaction of 98% in the US.

Wearable phone and accessories revenue was $9.3 billion down 3% year over year. We had a September quarter record in Europe, and we saw strong performance in several emerging markets around the world. Apple Watch continues to expand its reach with nearly two-thirds of customers purchasing an Apple Watch during the quarter being new to the product. And customer satisfaction for the watch was recently measured at 97% in the US.

Maestri on services

Services had a great quarter. We reached a new all-time revenue record of $22.3 billion up 16% year over year. And we’re happy to see growth coming from all categories and every geographic segment which is a direct result of the strength of our ecosystem. Our install base of over 2 billion active devices continues to grow at a nice pace and establishes a solid foundation for the future expansion of the ecosystem. And we continue to see increased customer engagement with our services. Both transacting accounts and paid accounts grew double digits year over year each reaching a new all-time high.

Also, our paid subscriptions showed strong growth. We have well over 1 billion paid subscriptions across the services on our platform nearly double the number we had only three years ago. And finally, we continue to improve the breadth and quality of our services from exciting new content on Apple TV Plus and Apple Arcade to additional storage tiers on iCloud.

We believe our customers will love these new offerings.

On the enterprise

Turning to enterprise, we are excited to see our business customers in both developed and emerging markets expand their deployment of Apple products and technologies to drive business innovation and employee satisfaction.

Starbucks continues to invest in Apple technology to bring the best experience to the customers and employees including tens of thousands of iPads across all retail stores to help their teams streamline order management operations and training. In addition, Starbucks recently refreshed over 10,000 Macs to the latest M2-powered MacBook Air for all store managers enabling them to do the best work and improve productivity.

And in Indonesia, popular technology company GoTo is offering Mac as a choice so that employees can have the best tools to be most productive. Today, more than half of its workforce are already choosing Mac for work.

Cash and forecasts

Let me now turn to our cash position and capital return program.

We ended the quarter with over $162 billion in cash and marketable securities.

We increased commercial paper by $2 billion, leaving us with total debt of $111 billion.

As a result, net cash was $51 billion at the end of the quarter and our goal of becoming net cash neutral over time remains unchanged. During the quarter, we returned nearly $ 25 billion to shareholders, including $3.8 billion in dividends and equivalents and $15.5 billion through open market repurchases of 85 million Apple shares. We also began a $5 billion accelerated share repurchase program in August, resulting in the initial delivery and retirement of 22 million shares.

Taking a step back as we close our 2023 fiscal year, our annual revenue was $383 billion. While it was down 3% from the prior year, it grew on a constant currency basis despite a volatile and uneven macroeconomic environment. Our year-over-year revenue performance improved each quarter as we went through the year and so did our earnings per share performance as we reported double-digit EPS growth in the September quarter.

Emerging markets overview

We are particularly pleased with our performance in emerging markets, with revenue reaching an all-time record in fiscal 2023 and double-digit growth in constant currency. We are expanding our direct presence in these markets from new Apple retail stores in India to online stores in Vietnam and Chile.

We continue to work with our partners to offer a wide range of affordability programs so that we can best serve our customers.

We are very excited about the momentum we have in these markets and the opportunity ahead of us. As we move ahead into the December quarter, I would like to review our outlook, which includes the types of forward-looking information referred to at the beginning of the call.

The color we are providing today assumes that the macroeconomic outlook doesn’t worsen from what we are projecting today for the current quarter. Also, on foreign exchange, we expect a negative year-over-year revenue impact of about 1% point.

Forward expectations

As a reminder, the December quarter this year will last the usual 13 weeks, whereas the December quarter a year ago spanned 14 weeks. For clarity, revenue from the extra week last year added approximately 7 percentage points to the quarter’s total revenue. Despite having one less week this year, we expect our December quarter total company revenue to be similar to last year.

- We expect iPhone revenue to grow year-over-year on an absolute basis.

- We also expect to grow after normalizing for both last year supply disruptions and the one extra week.

- We expect Mac year-over-year performance to significantly accelerate from the September quarter.

- We expect the year-over-year revenue performance for both iPad and wearable-soman accessories to decelerate significantly from the September quarter due to a different timing of product launches. On iPad, we launched a new iPad Pro and iPad 10th generation during the December quarter a year ago.

- For the wearables category, last year we had the full December quarter benefit from the launches of the AirPods Pro 2nd generation to watch SE and the first watch Ultra.

- For our services business, we expect the average revenue per week to grow at a similar strong double digit rate as it did during the September quarter.

- We expect gross margin to be between 45 and 46 percent.

- We expect OPEX to be between $14.4 billion and $14.6 billion.

- We expect OINE to be around negative $200 million excluding any potential impact from the market to the market of minority investments and our tax rate to be around 16 percent.

- Finally, today our board of directors has declared a cash dividend of $0.24 per share of common stock payable on November 16, 2023, to shareholders of record as of November 13, 2023.

Highlights from analyst questions

On China

Tim Cook: “Yeah, if you look at how we did in Greater China for the quarter, we came in at on a revenue basis minus two. But one thing to keep in mind here is that the FX impact was nearly six points. So, we grew in constant currency. And underneath that, if you look at the different categories, iPhone actually set a September quarter record in mainland China.

And the, what pulled down the performance was a combination largely of Mac and iPad. Services also grew during the quarter. And the Mac and iPad suffered from the same issues that the company did with the compare issues to factory disruptions in Q3 that were filled subsequently in Q4 of 22.

“We had the top four selling phones in urban China for last year. And I was, I just, I took a trip over there and could not be more excited about the interactions I had with customers and employees and others.”

Apple and capital expenditure

Tim Cook: “Well, the big areas of investment for us are tooling and equipment for manufacturing plants, our investments in data centers, and our investments in our own facilities, both corporate facilities and retail stores. Both for the tooling in our plans and, you know, our data center investments, we tend to have a bit of a hybrid model where we share some of the investments with our partners and suppliers. And so maybe that’s why you see sometimes a bit of variability. But over the last few years, we made all the investments that we needed to make. And obviously we’re planning to make all the investments that we believe are needed and appropriate in order to continue to innovate.”

On accelerating services growth

Tim Cook: “We had a really strong quarter across the border, Amit, because both geographically and from a product category standpoint, we saw very significant growth. I mentioned the records on a geographic basis. And from a category standpoint, literally we set records in each one of the big categories. We had all-time records for App Store, for advertising, for cloud, video, Apple care, payments, and a September quarter record for music. So, it’s hard to pick one in particular because they all did well. And really then we step back, and we think about why is it that our services business is doing well and it’s because we have an installed base of customers that continues to grow at a very nice pace. And the engagement in our ecosystem continues to grow. We have more transacting accounts, we have more paid accounts, we have more subscriptions on the platform. And we continue to add content and features. We’re adding a lot of content on TV+, new games on Apple Arcade, new features, new storage plans for iCloud. So, it’s the combination of all these things and the fact that the engagement in the ecosystem is improving and therefore it benefits every service category.”

On VisionPro

Tim Cook: “There’s a tremendous amount of excitement around the Vision Pro. And we’ve been very happy to share it with developers. We have developer labs set up in different parts of the world so that they can actually get their hands on it and are working on apps. And I’ve been fortunate enough to see a number of those. And there’s some real blow away kinds of things that are coming out. And so that all looks good.

“There’s never been a product like the Vision Pro. And so, we’re purposely bringing it out in our stores only so we can really put a great deal of attention on the last mile of it. We’ll be offering demos in the stores, and it’ll be a very different process than the normal grab and go kind of process.”

On Generative AI

Q: “So, lots of companies are experimenting with generative AI. I’m curious about what kind of efforts you have?”

Tim Cook: “If you kind of zoom out and look at what we’ve done on AI and machine learning and how we’ve used it, we view AI and machine learning as fundamental technologies. And they’re integral to virtually every product that we show. And so just recently when we shipped iOS 17, it had features like personal voice and live voicemail. AI is at the heart of these features. And then you can go all the way to then life saving features on the watch and the phone like fall detection, crash detection, ECG on the watch. These would not be possible without AI. And so, we don’t label them as such, if you will.

“We label them as what their consumer benefit is.

“But at the fundamental technology behind it is AI and machine learning. In terms of generative AI, we have obviously we have work going on. I’m not going to get into details about what it is because you know, as you know, we don’t, we really don’t do that. But you can bet that we’re investing, we’re investing quite a bit. We’re going to do it responsibly and it will, you will see product advancements over time that where those technologies are at the heart of them.”

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and AppleDiscussions groups on MeWe.