TSMC up 35% in slow tech quarter, probably on Apple’s shine

Apple supplier TSMC is having a good time, announcing quarterly revenues up 35.5 percent, year-on-year – and the company says demand for high performance computing devices and automotive electronics drove growth.

Perhaps those slow iPhone sales reports are dud?

This success comes in what is traditionally a slow quarter in tech. Might this suggest reports of weak iPhone sales are over-exaggerated?

I think it does.

The results also topped the company’s own guidance.

Apple is TSMC’s biggest single customer. It accounted for 25.9% of the company’s revenue in the December ’21 quarter,a report has claimed.

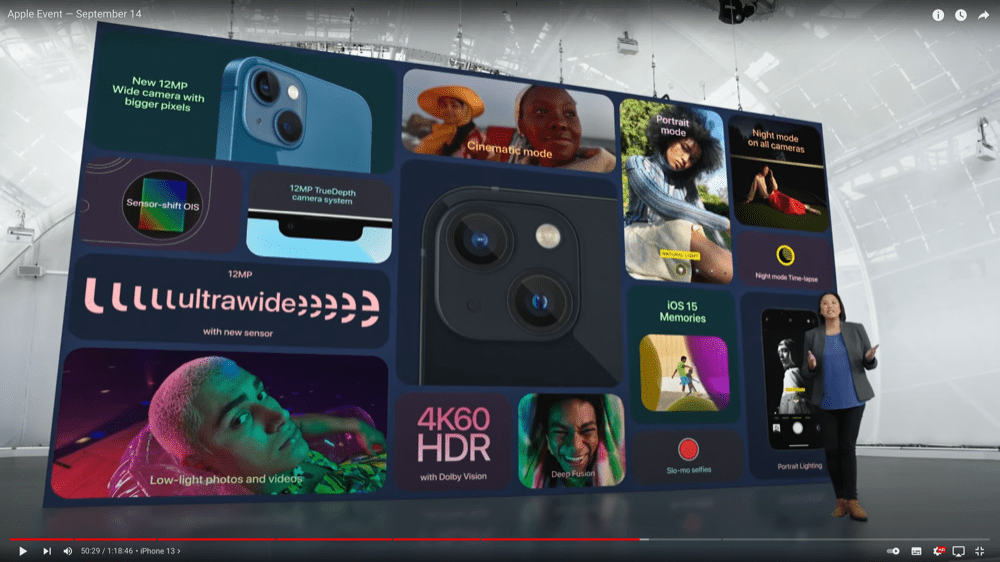

It’s important not to read too much into different sets of data, but it’s hard not to think TSMC is probably churning out a large quantity of Apple Silicon for use in Macs, iPads, and iPhones. It may even begin to make 5G modems for Apple from next year.

That’s something that bodes well for the future.

iPhone 13 Pro slide

Apple’s supply chain boom

After all, another Apple supplier, BOD, is boosting OLED panel production by 70% to meet demand. Apple uses these in iPhones and is expected to introduce them to other products at some point.

BOE is also developing an OLED display tech to build panels that are 30% more energy efficient while being brighter and lasting longer than existing OLED displays. The company is also building a production capacity to make larger OLED displays.

That TSMC managed to deliver growth even while taking precautions against COVID-19 and changing working practises to manage demand makes this even more remarkable.

In a very brief revenue report, the company said:

“TSMC (TWSE: 2330, NYSE: TSM) today announced its net revenue for March 2022: On a consolidated basis, revenue for March 2022 was approximately NT$171.97 billion, an increase of 17.0 percent from February 2022 and an increase of 33.2 percent from March 2021. Revenue for January through March 2022 totalled NT$491.08 billion, an increase of 35.5 percent compared to the same period in 2021.”

[Also read: Apple’s chip maker TSMC now accounts for over half its market]

TSMC will make chips in America

Perhaps also interesting, considering nonsense reports claiming iPhone sales are down, the company says it isn’t planning to change its capital spending plans this year. TSMC plans capex spend between $40-$44 billion this year, up from $30.4b in 2021. Within those plans it will open a new chip manufacturing center in Arizona, US, next year.

The company does face a tough business environment. The war in Ukraine and ongoing pandemic is creating shortages in some key components, including silicon and industrial gases, which may well impact production capacity.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.