When will Apple Pay do something like this?

A smart move by Revolut

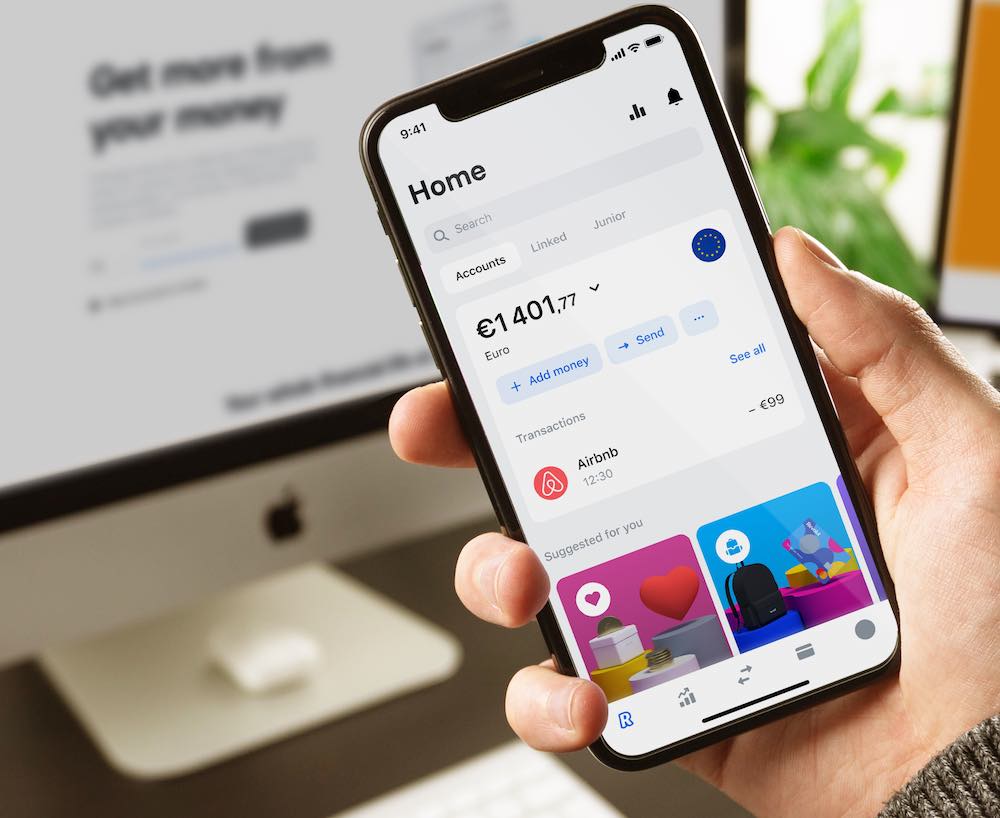

I use Revolut. I like it. You can use it too thanks to this affiliate link. I think the smart challenger banking service is doing a great job cutting ahead of traditional fintech companies. And its latest idea is something I imagine other banks and even Apple Pay may move to emulate: a Chrome browser plugin called Revolut Shopper.

Though why it’s not yet on Safari perplexes me.

What is Revolut Shopper?

I’m not going to pretend this is as significant as most of my Apple coverage. I do think it’s telling as a model that shows how disruptive fintech companies – including Apple – are driving innovation in the space.

What Revolut Shopper does is combine discount shopping codes with cashback deals the company already has with partner retailers such as Apple or Nike. When you shop, the Chrome browser plugin sources the best deals and lets you pay using single-use Revolut cards. Those are temporary cards with a unique, single-use number, leaving your genuine card number hidden to protect you against scams.

Why doesn’t Apple Pay offer this?

Why is it smart?

I think this is a smart service that focuses on what people are actually doing with cards online – shopping. It answers significant pain points: better prices and protection against fraud. It also hits users in the sweet spot by being where they are (in the browser).

I don’t suppose it’s particularly original. I’m certain there will be others trying similar things, but it’s still an interesting approach. I’m surprised some of the big banks or even Apple Pay haven’t explored this kind of model.

If I have one reservation it may be that when you use a service like this you are very likely to be creating data. I imagine this belongs to Revolut as a condition of service. The company says it doesn’t collect data on the Chrome listing page.

I can also imagine this is the kind of interaction at least some advertising dollars will go to now Apple has made data capture difficult with App Transparency.

Why it matters

What bugs me is the simplicity.

Across the planet there are banks that already offer cashback deals and provide credit/payment card services. They already know how we make use of these things.

Yet they didn’t give us this. Why?

We also know the scale of the move to virtual payments. Africa will conduct transactions worth $2.5tn to $3tn a year, says Boston Consulting Group.

You’d imagine someone might have figured out how to make those services available in the browser and how to combine useful features such as fraud protection with cashback and cut price deals. The thing is, so slow are traditional banks to embrace change like this that those services never happened. Until challengers like Revolut appeared.

These are the kind of fintech and personalized service solutions that should see some innovation in the space in the coming years. And while I don’t think Revolut checkout really competes with the daily cashback deals you get with Apple Card, both services inhabit a similar space. And both illustrate why the entire personal fintech sector has to change, particularly for increasingly digital audiences.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.