Why Apple’s Credit Kudos deal is a big business opportunity

Pay it.. later…

Apple, which has 154,000 employees, has allegedly not purchased many smaller firms in recent months, but one it did acquire, Credit Kudos, will likely have a big impact on the company’s business as it enters what will likely be the lucrative Buy Now Pay Later space.

Why buy now when you can buy later?

Apple entered a whole new business sector when it introduced Apple Pay Later at WWDC 2022.

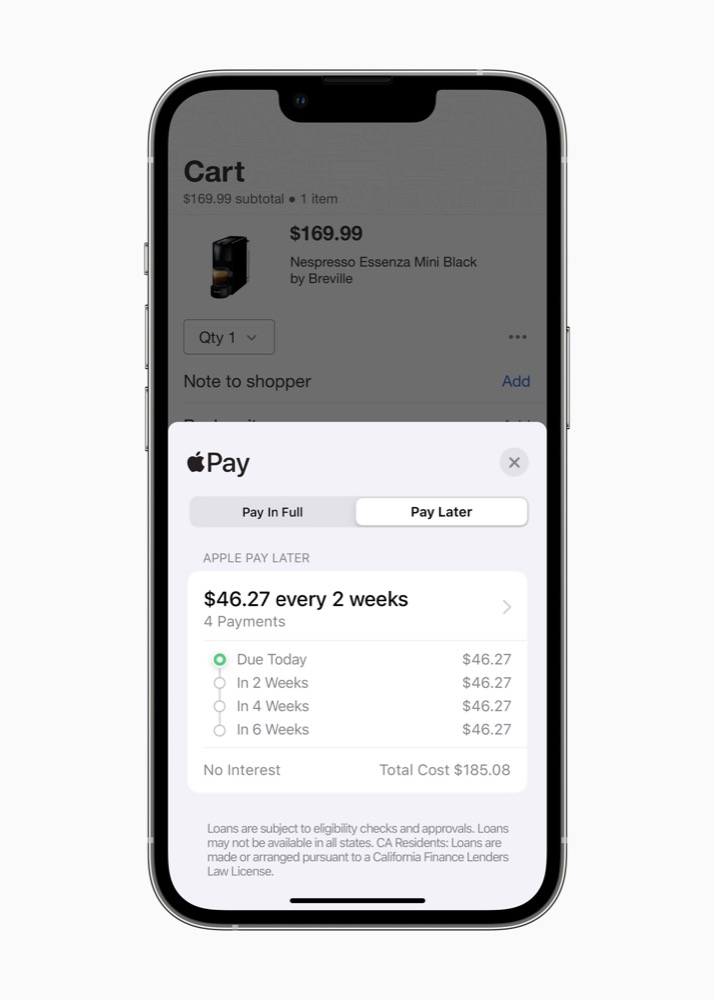

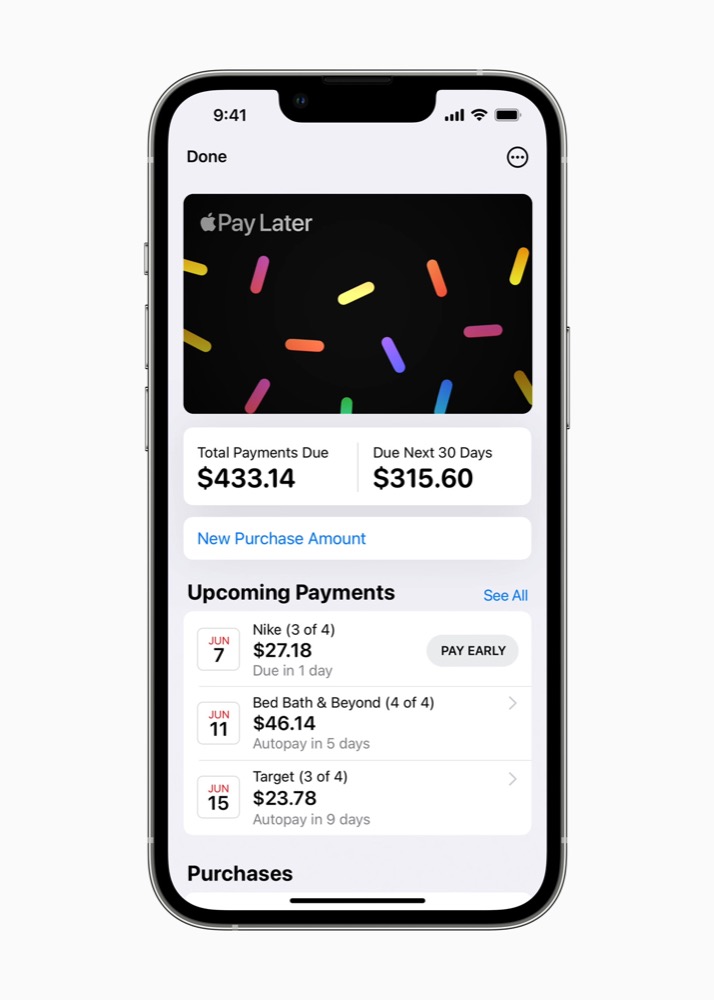

Available at present only in the US in partnership with Mastercard and already subject to some regulatory scrutiny, the service lets people split the cost of an Apple Pay purchase into four equal instalments without incurring interest or late fees.

Of course, the beauty of most BNPL services is that they extend small quantities of credit without a full credit check. However, Apple still won’t want to make poor investments there, which presumably is why it acquired innovative UK credit referencing start up, Credit Kudos earlier in 2022.

Credit Kudos enabled lenders to provide credit to borrowers who may have been declined under traditional credit scoring systems. It developed its recommendations using a combination of machine learning, transaction, and loan outcome data. The company had built a good reputation for what it did, which of course Apple needs (or will need) to help underpin its Apple Pay Later service.

Apple seems to be handling the credit check and advancing the loans?

What is the market potential here?

The BNPL market potential is massive.

It currently accounts for just $34b in the US, but a recent Juniper Research report predicts huge international growth in demand for such services moving forward.

That report tells us the number of users of such services will exceed 900m globally by 2027, up from 360m today. The global BNPL industry is estimated to be worth around $157 billion at the moment.

Growth will in part be driven by the ongoing economic crisis, consumers will seek BNPL deals to avoid paying more in interest. BNPL deals are usually interest free, so long as you pay on time.

Now, what Apple is offering is interesting because it is effectively turning its devices into virtual cards for BNPL deals. Shoppers won’t need to reach a deal with the shop they are in, or make any additional negotiation other than through the Apple Pay service they already use.

That lack of friction should help.

Apple Pay Later

Juniper thinks so

Juniper Research predicts that,

“Adoption of virtual cards, where digital only cards are used for purchases, will increase the usage of BNPL (Buy Now Pay Later) solutions, as they only require merchants to accept card payments – overcoming previous limitations on growth. The advancement of virtual cards allows BNPL schemes to compete with credit cards; particularly in-store, where single use BNPL cards can be used within a digital wallet to complete contactless transactions.”

There is one more reason Apple may be building a big business opportunity here: India.

Juniper Research identifies India as having huge potential for growth in this market, predicting the number of users of such services will hit 116 million by 2027, up from 25 million today. This is due to an increase in online shopping among consumers there.

For Apple, that opportunity dovetails extremely well with all the other work the company has been doing in that country, which has a highly educated, literate workforce and stands to benefit from increase deployment of manufacturing and other commercial opportunities as big business seeks to diversify supply chains. That should translate into a rising middle class, which is precisely the market Apple most likes to reach – higher income, discerning consumers.

860 million potential customers on day one

It’s also important to note that Apple Pay Later has the potential to hit the ground running (very fast, internationally) on strength of the 860 million paid subscribers Apple has now attracted to its services. This is likely to be a profitable operation to drive the company even more deeply into fintech, generating a cumulatively rewarding truck full of micropayments.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.