Will Apple and Jamf earnings show growth in Mac enterprise?

What will the shapes of these calls tell us about Apple in the enterprise?

Two earnings calls in close proximity should provide us with solid sense of Apple’s reach into the enterprise markets in the coming weeks, Apple’s on July 28 and Apple in the enterprise leader, Jamf, August 4.

What I’ll be looking at

I won’t get into the zoomed-out expectations, but what I’ll be interested to learn from Apple will be how well its devices are selling into enterprise markets. The company usually shares one or two highlights around this, and will no doubt use the financial call to make mention of its recent SME-friendly deal with T-Mobile.

Apple won’t tell us too much, but as consumer markets soften it seems likely the company’s hard won enterprise sales will help keep the bean counters happy.

Jamf, long the leader in Apple in the enterprise integration, will be the bellwether for Apple in the enterprise. Company management will report its results with a conference call and webcast at 3:30 p.m. CT (4:30 p.m. ET).

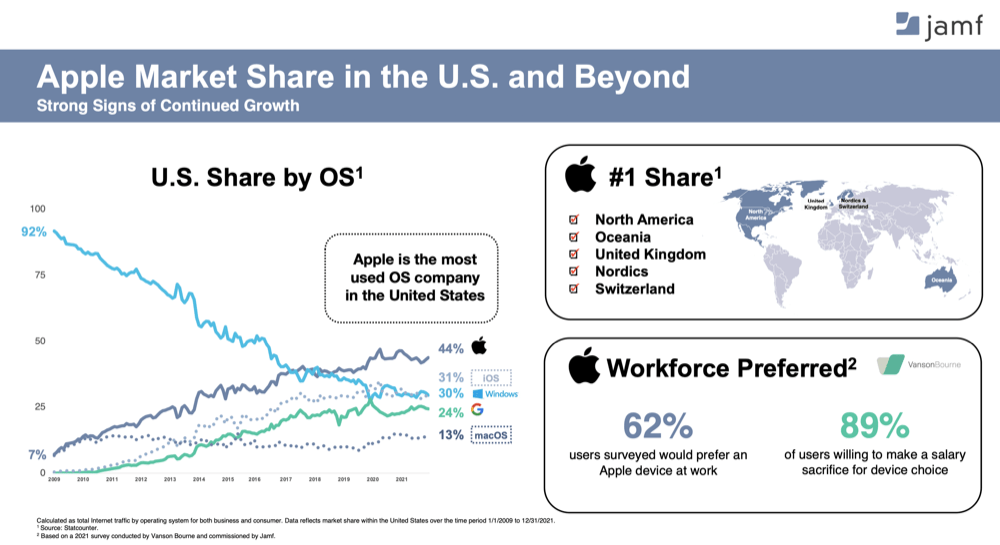

During its last call, Jamf shared its growth story with shareholders, explaining how it has generated 62,000 customers since launch in 2002. It explained how Apple has become the most used OS company in the US and shared a chart to show how its own growth has tracked that achievement. That’s what I will be watching for, of course, hoping to get some insight into how robust enterprise markets have been for Jamf and thus, by inference, Apple.

What do I expect?

I’m not buying the disaster hype that’s been going round. I don’t think anyone has a solid insight, other than that while we can expect declining consumer confidence to bite a little, we’ve also seen how shoppers migrate to quality when bad times come, as they want to invest in kit that will last them for a few years and get them through the bad times.

Jamf shared this slide during its last call

I’ve also seen enough reports now that suggest Apple’s share of the overall markets it plays in continues to rise, which means the company’s marketshare is increasing, even if numbers decline a little. What I expect to learn is that Apple’s enterprise marketshare also continues to increase, creating even more opportunity for it to build out that services income. After all, what’s unattractive about a platform that gives you everything you need to get work done, and gives you access to a range of entertainment services to occupy your downtime?

In any case, even if the economy does take a dive, my bet is that Apple will still come through it more strongly than its competitors, and enterprise IT will continue to go where the employee choice is, and that’s Apple.

We’ll have the best insight we’re going to get on this come August 5, once these announcements are made. What are you expecting?

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.