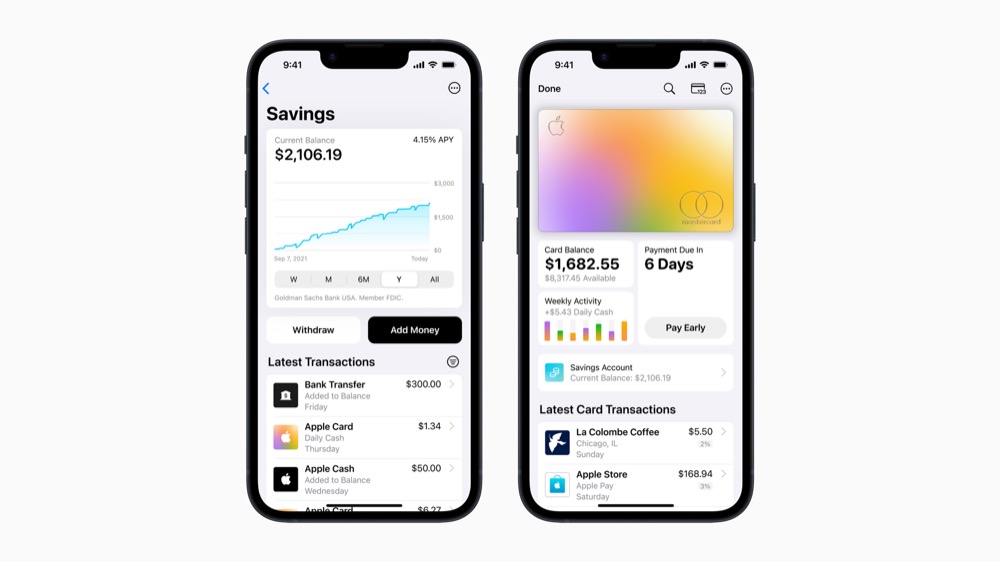

With Savings, Apple has actually built a Magic Money Tree

If you have $250,000 to save, Apple is offering you a guaranteed $11,250 income per year.

Apple’s high-yield savings account has already proved itself, with almost a billion dollars in deposits stashed inside the service in just four days. And the only way is up.

A billion in four days is a good start

You see, what many may have missed when the company introduced the scheme is that the nature of the people it was offering the high-yield savings service too means it instantly had access to the kind of individuals with cash to put aside.

What is happening

That’s not because of any inherent class bias, it just simply reflects three key metrics:

- Apple is offering a much higher rate of interest than most savers currently enjoy in the US. That 4.5% rate is incredibly tempting to savers used to being offered under 1% elsewhere – it’s the kind of rate that more than justifies the effort of shifting money between accounts.

- The savings account is only available to existing Apple Card users. What this means is super-simple – it means it is being made available to people with good credit, which basically limits the audience to those more likely to have a little disposable income. It means that, inherently, Apple and Goldman Sachs are offering people who have a little money a better rate of intertest than they’ll find elsewhere. Of course, they are signing up.

- The nature of iPhone users. It’s not a universal rule, but it is known that iPhones are also popular among high net worth individuals. These are the kind of people who would pay for gold and jewellery-encrusted iPhones. Why wouldn’t they pop huge chunks of cash into an account that paid them 4.5%?

What’s new is that the latest news that Apple’s service attracted $990 million in deposits in just four days confirms all three prepositions – these people will save with this account.

As word gets out you should expect to see tens of millions more saved into the Savings account, and this should also stimulate a fresh wave of Apple Card sign-ups in the US. Reports claim 240,000 savings accounts were opened by the end of launch week.

Who do you trust?

There is a second context to this to think about.

We’ve just seen the collapse of three US banks in the last few weeks. Banks are competing to attract and retain deposits to help shore up their businesses. First Republic Bank, the most recent collapse, recently lost $100 billion in deposits as people panicked following the earlier collapse of Silicon Valley Bank.

Facing this kind of insecurity savers will naturally siphon their cash to those offering the best interest, and that billion dollars saving in Apple Savings in Week One should logically only be the beginning of this money parade.

Apple has a magic money tree

That parade may well also nurture additional Apple Card use, if only as high net worth individuals begin to use the card, they need to get to earn that good rate of interest.

It also expands the potential market for use of Apple’s new Pay Later service and may well generate even more demand from users outside the US who would like to join the Apple Card massive.

The only limitation I can see is that the amount of cash any individual can stash in these accounts is $250,000 – though 1,000 of those big accounts is still $2.5b savings generating a massive $112.5 million in interest every single year.

(And if you are generating returns like that, can I please humbly remind you that my server fee fund is always desperately short of support and I’d appreciate any help you can provide, while I wait on the inevitable lottery win I still refuse to accept isn’t coming my way).

Can Apple’s money parade tempt people to save?

Thrivers, strivers, and big wins in tiny numbers

I think it can, and as the company’s wealthiest US customers get to understand the table stakes in this game, I wouldn’t be at all surprised to see the quantity of cash held in these accounts expand almost as fast as iPhone market share.

And that’s going to generate even higher degrees of Apple platform stickiness, will convert into additional Mac and accessory purchases, and means that even in the current incredibly tough economic market, Cupertino is building a bulwark from among the world’s wealthiest to help the company thrive in tough times.

That’s pretty smart. And while the profits Apple generates from this side of its services offering may be tiny on some metrics, a tiny slice of big numbers grows large fast. Now repeat it globally and watch the flip.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.

I’m sure the APY will change but it’s currently 4.15% (not 4.5%) which would be $10,622.50