WWDC: Apple opens a new business with Apple Pay Later

Apple Pay Later

Apple quietly entered a potentially huge new business sector when it introduced Apple Pay Later at WWDC 2022. While available only in the U.S. the move gives Apple a foothold in the promising ‘Buy Now Pay Later’ (BNPL) market. The company no doubt hopes to turn user trust into an opportunity in the space.

WWDC Apple Pay Later – spread the cost of living

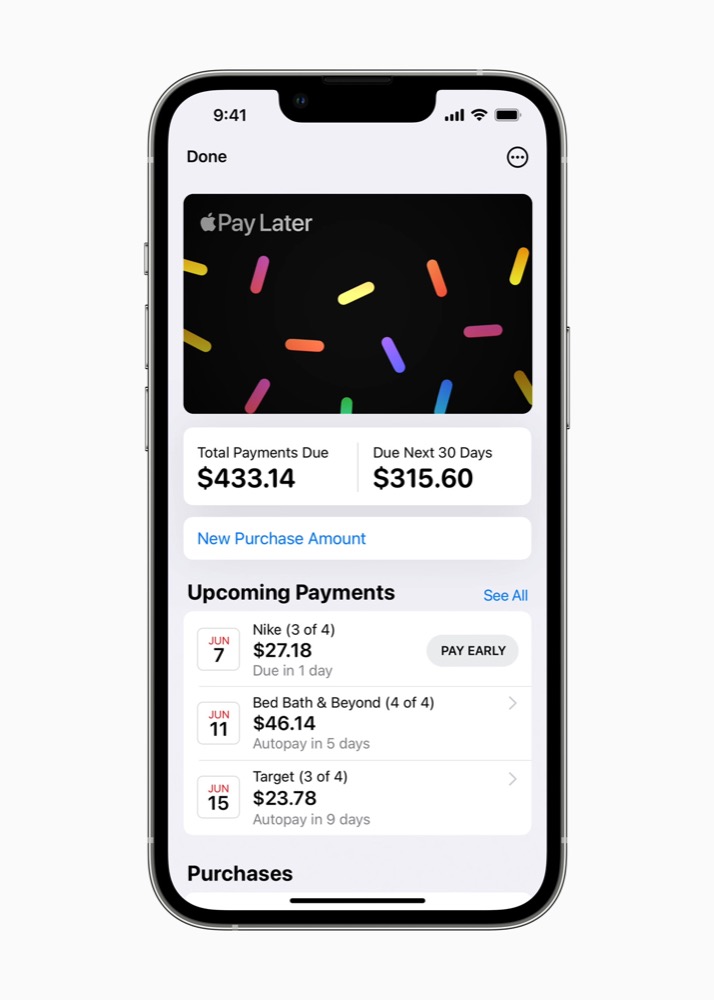

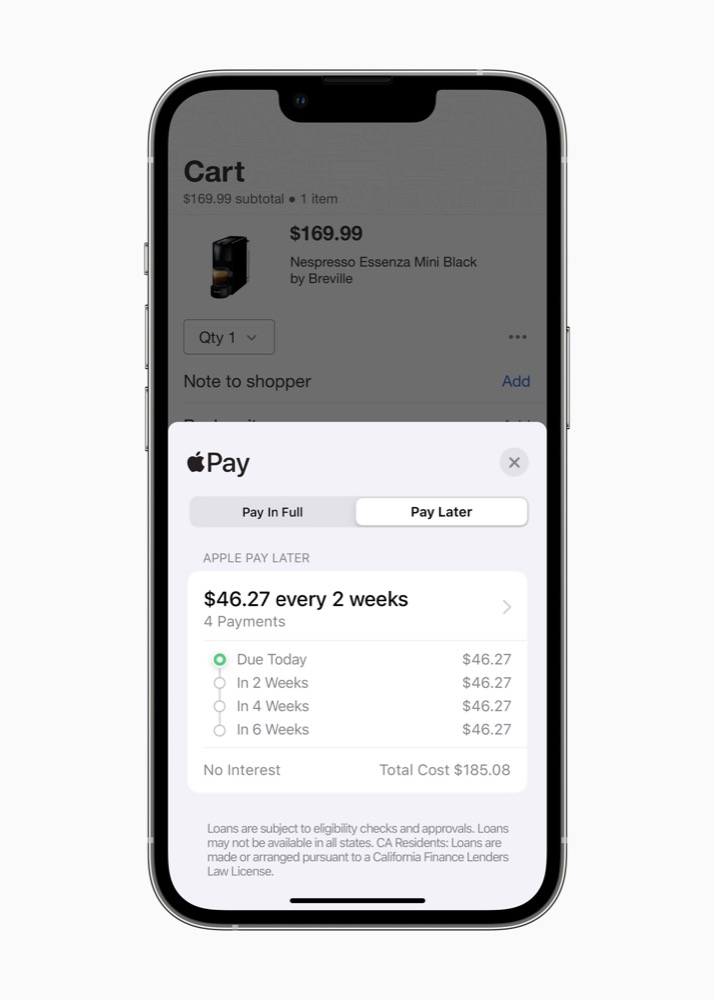

Apple officially announced its Apple Pay Later offering at the 2022 Worldwide Developers Conference (WWDC). The service will allow consumers to split the cost of an Apple Pay purchase into four equal instalments without incurring interest or late fees.

It will be powered by the Mastercard network and will be available anywhere Apple Pay is accepted in the U.S., including online and in the shops.

“Built into Apple Wallet and designed with users’ financial health in mind, Apple Pay Later makes it easy to view, track, and repay Apple Pay Later payments within Wallet. Users can apply for Apple Pay Later when they are checking out with Apple Pay, or in Wallet. Apple Pay Later is available everywhere Apple Pay is accepted online or in-app, using the Mastercard network.4 Additionally, with Apple Pay Order Tracking, users can receive detailed receipts and order tracking information in Wallet for Apple Pay purchases with participating merchants,” Apple said.

So, why is Apple doing this?

The potential market is large. The North America ecommerce market is worth around $900b in 2021, and BNPL overall accounts for just $34b of that.

Apple is treading on toes, but this may not be quite as damaging as some may think. Affirm leads the BNPL market in the US, where it took a GMV of $13b of the $34b BNPL market in 2021.

What Affirm says about Apple’s move

An Affirm spokesman explained what the company fells about Apple’s entrance into the market, saying: “Consumers, especially now, are looking for more transparent and flexible alternatives to credit cards. Affirm has offered this for nearly a decade through personalized payment plans with term lengths ranging from six weeks to 60 months. By underwriting every single transaction, we empower consumers to responsibly pay over time and help merchants drive growth, turning browsers into buyers. Today, we have more than 200,000 integrated merchant partners and consumers can use Affirm at virtually any retailer via the Affirm app. Even as more players join the movement we started, the prize remains massive, and Affirm is well-positioned to win. We simply don’t think anyone can do what our team and our technology can do.”

What Morgan Stanley thinks

In a note to clients, Morgan Stanley points out that Apple’s advantage is acceptance. Apple Pay is accepted at 85% of US retailers and any in-store location that accepts contactless payments (according to Apple). The service will also be made available on every Apple Pay purchase once they sign up for Apple Pay Later.

All the same, the analysts think Affirm has a strong competing position. Affirm offers a broader set of offerings, including Split Pay, 0% APR loans, and interest-bearing loans (long and shorter duration). Apple, on the other hand, offers just a 6-week zero-interest offering, more like Blocks Afterpay service.

One thing that isn’t yet clear is how Apple is underwriting the service. Is it working with Goldman Sachs, Mastercard, or financing this from its own resources?

One more thing in Morgan Stanleys research is of interest. Apple’s Tap to pay service will launch this month, allowing merchants to use an iPhone to take payments. While the analyst firm feel pretty positive about this, they warn, “we are still hesitant that this type of system can actually take off.”

![]()

Why?

Because smartphones are expensive and not necessarily sufficiently robust to handle this kind of use. “In our view, not much has changed from more than 10 years ago when retailers experimented with iPhones (along with Android phones and Windows phones) as terminals and the breakage and replacement costs proved too high to maintain.”

We’ll see about that, particularly in conjunction with the AppleCare component of Apple Business Essentials.

Also read:

- WWDC22: What’s new in macOS Ventura? Quite a lot actually…

- WWDC: Apple surges forward, begins M2 chip transition

- WWDC22: Apple Watch gets big health upgrades

- WWDC, iOS: Lockscreen gains widgets, more ways to share

- WWDC opens doors with good news from AirPods & HomePods

- WWDC22: Apple makes devs API-er with Weather and more

- With iPad OS 16, Apple asks, ‘what’s a computer’?

- Apple’s ‘Innovation engine at full throttle’, Morgan Stanley

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.